The Types of Structured Products

The types of Structured Products can broadly be classified thus:

As the descriptions of the products mention, Structured Products combine different assets together, including stocks, bonds, indices, commodities, currency pairs, and interest rates, which eventually determine the payoff. Many Structured Products offer the ability for investors to change certain underlying assets before maturity for hedging and risk mitigation purposes, through contracts like Options and Swaps.

Structured Products combine different assets

Understanding Options and Swaps

An Option is a contract between two parties wherein the buyer can buy or sell an underlying security at a predetermined price, either before (American Options) or on (European Options) an expiration date. There are two types of Options: call options and put options.

Call Options are used when the price of the underlying asset is expected to rise; then, the buyer can buy an asset at the lower, predetermined price (known as the strike price) and sell at the higher market price. Put Options are used when the underlying asset is expected to fall in price. If the price falls below the strike price, the investor can sell the asset at the higher strike price, avoiding a loss.

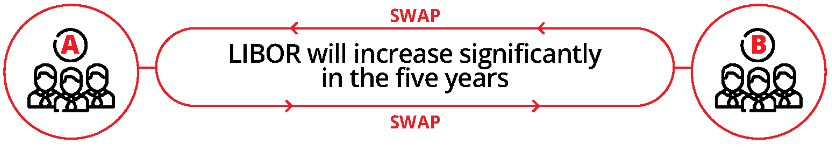

Swaps, on the other hand, are contracts through which two parties exchange fixed interest payments for floating interest payments. Fixed Interest Rate is that which remains constant until maturity; Floating Interest Rate is variable and changes according to a benchmark rate, like LIBOR

An Illustrative Example

To illustrate this better, let’s consider an example:

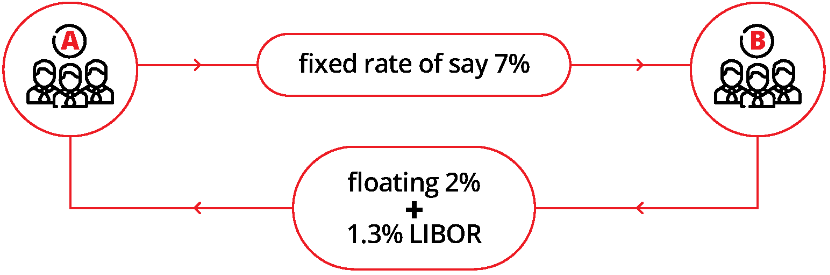

Company A issues Rp 10 million in five-year-bonds at an interest rate of 2% LIBOR + a 1.3% base interest.

If Company A feels that LIBOR will increase significantly in the five years, it can enter into a swap with Company B,

which is willing to pay Company A an annual rate on the principal (Rp 10 million) in exchange for receiving a fixed rate of say 7% on the notional principal.

Company B will enter into this kind of a contract if it speculates that LIBOR will not rise significantly over the five years

Other type of Swaps are Commodity Swaps (exchange of floating commodity price), Credit Default Swaps (payment of lost principal and interest on a loan if a buyer defaults on the payment), Currency Swaps (exchange of payments in different currencies), Debt-Equity Swaps (exchange of debt for equity), and Total Return Swaps (exchange of total return for fixed interest rate).

The Simple Summary

Structured Products are created by combining various underlying assets and feature derivative contracts that can be used to minimize risk and increase profits. Because of the emphasis on speculation in some of these contracts, however, we strongly advise thorough market research before investing in any product, with careful consideration of your financial and investment goals. In Part 3 of the series, we will bring to you a detailed guide on how Structured Products benefit different goals and different profiles.