Are you looking to gain exposure to different markets, but wary of the associated risks?

Structured Products are designed to provide such exposure to various market movements while minimizing risk through a customized combination of products. In this three-part series, we will give you the complete lowdown on Structured Products, including a deep dive into the components of Structured Products and interest-rate linked investments. In this first part, however, we will start with the basics of Structured Products and how they can help you achieve your specific investment goals.

What are Structured Products?

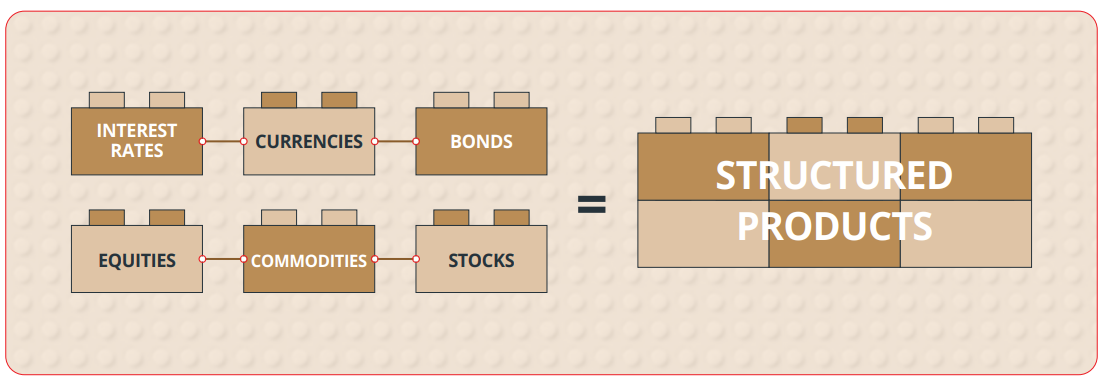

Structured Products are a type of investment that combine various traditional investments like stocks, bonds, or options with derivatives, in order to meet specific investor needs and goals, while also providing risk management. They are customized to provide exposure to particular investment strategies — including capital protection, market exposure, diversification, and volatility management — and specific asset classes.

Some of the asset classes featured in structured investments are equities, commodities, currencies, interest rates, stocks, and bonds. These are added to the product after starting with a traditional security, such as a Certificate of Deposit (CD) or debt security.

Derivatives like options and swaps are also important components of Structured Products. They allow exposure to certain market movements without directly owning the underlying assets. Nevertheless, it is the underlying assets that determine the payoff from any Structured Product.

What is the Payoff?

The payoff on Structured Products is non-traditional, in that it is not derived from cash flow but from the performance of the underlying asset. The return for individual underlying assets is calculated by a Participation Rate, which determines the percentage of the asset that the investor will participate in. For example, if the participation rate is 80%, and the asset gains 10% the investor would receive an 8% return.

However, many Structured Products also feature Principal Protection, whereby a portion of the invested capital is guaranteed to be returned to the investor, even if the underlying assets perform poorly. This makes Structured Products attractive to even conservative and moderate investors looking for low-risk investments.

A Representative Example

To understand this better, let’s consider a representative example:

Say Henry purchases an Equity-Linked Note (ELN)1 worth Rp 10,000, at a 70% participation rate, with a maturity period of three years, and 100% principal protection at maturity 2. Over the three years, the ELN’s final payout will be determined by the performance of the stock.

However, if the asset value has decreased after three years, because of the principal protection, Henry would receive 100% of his investment back, i.e. Rp 10,000. Therefore, principal protection becomes one of the defining and important features of Structured Products, enabling low-risk investments.

1 an ELN is a structrued product that is structured to buy a strip-bond with a large percentage of the investment (say 80%), and the remaining (say 20%) is invested in call options. If the option appreciates in value, the returns will be added to the overall sum. If it doesn’t, the investor gets back the principal investment — called prinicpal protection.

2although most ELNs offer 100% principal protection, some assets may provide different rates.

Benefits, Risks, and Rewards

Some of the other benefits of Structured Products are of course customization, diversification, and also access to complex investment strategies, which would not be possible in traditional investments. Structured Products also provide low volatility, tax efficiency, larger returns than leverage, and positive yields in low yield environments.

Benefits of Structured Products

As always, however, we recommend studying and researching the market thoroughly before investing. It is especially prudent to get in touch with your investment advisor on the potential risks of Structured Products, including little liquidity and credit risks.

The Simple Summary

Structured Products offer diversity and exposure to different markets and assets, while minimizing the risks associated with owning any underlying asset, and are customized according to your investment goals, depending on your portfolio and profile. In Part 2 of this series, we will look at the components of Structured Products that enable these benefits in more detail.

Meanwhile, you can stay updated on market trends, investment opportunities, and other insights through CIO Insights.