Personal finance is intertwined with emotions, which have to be addressed before investing. It is important to understand your risk appetite - how much risk you are willing to take, how prepared you are to lose part or all of your capital, and whether you have the ability to make good any losses incurred.

Your risk appetite is a measure of the amount of risk you are willing to take for potential returns. Some people have a high-risk appetite and are not willing to accept the possibility of losing a significant part, or all of what they have invested. There are also people who are unwilling to risk even a single dollar on an investment – it’s more crucial to them to protect their wealth, than to grow it.

It is important to select investments that match your risk appetite, for a few reasons:

- You need to invest in a way that allows you to sleep soundly at night, as the risk is within your acceptable range.

- Besides your psychological comfort, an investment must also match your capacity to accept any losses. The amount of risk you can manage depends on various factors, such as your investment horizon (i.e. how long you will remain invested).

- Another factor that may influence your risk appetite includes your investment time frame. If you are looking to invest for a longer period time, you have time on your side to recoup any loss. If you are an investor with a shorter investment time frame, as you might be nearing retirement, investing in high-risk products are not for you.

Step #1: Understand your risk appetite DBS Risk Profiling Questionnaire helps you to understand your risk appetite. Assessment is made based on the following:

- Your investment experiences

- Your Ideal investment time frame

- Your capital loss capacity

- Your financial situation in the next 12 months

With the results, you can identify your risk profiling.

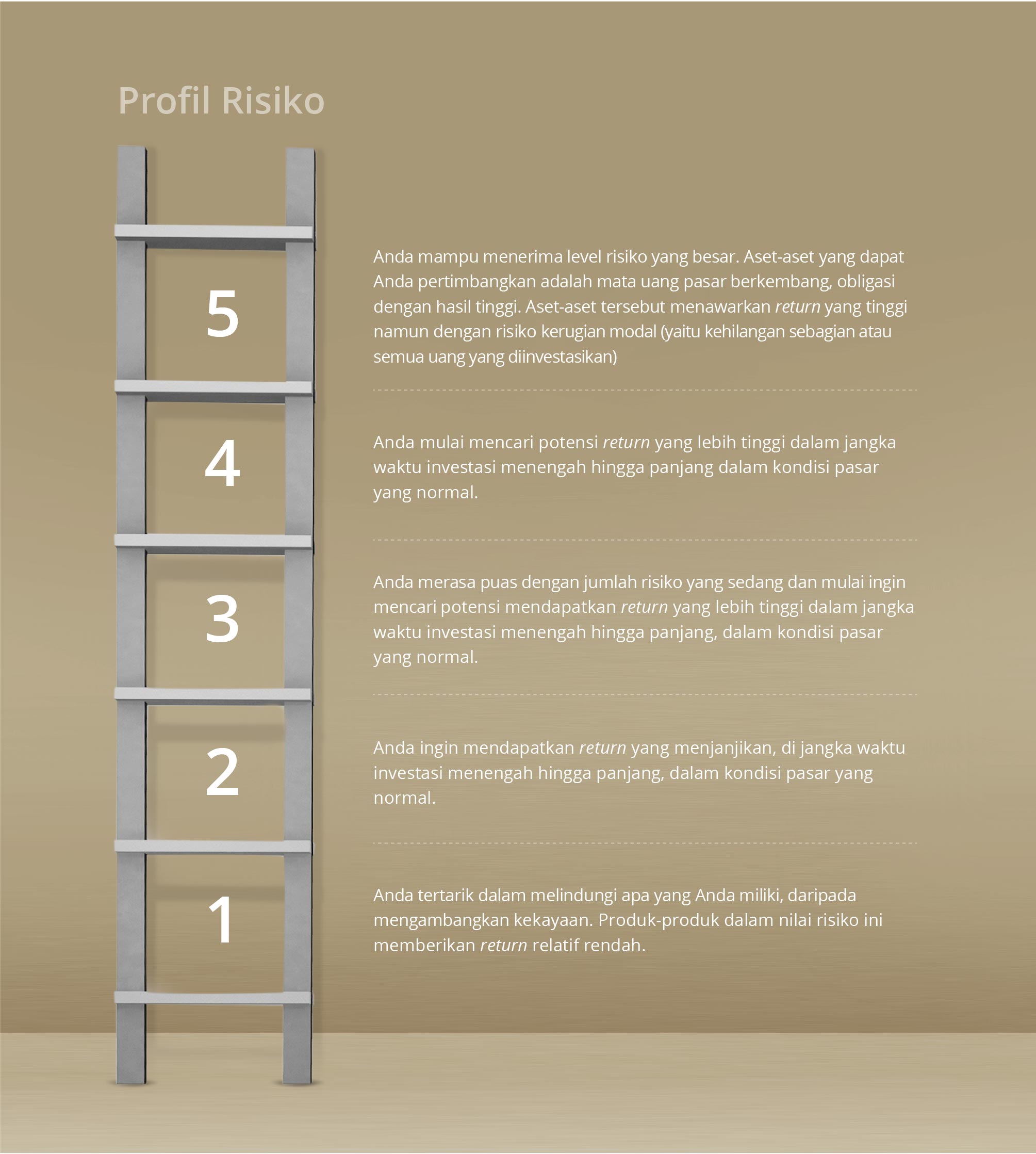

Step #2: Look at the product risk rating DBS has a risk rating method called Product Risk Rating (PRR). PRR measures a product’s risk from a scale of one to five, with one being the lowest, and five being the highest. Match your risk profile to funds that are a right fit to you, and decide which ones best complement your portfolio.

PT Bank DBS Indonesia is registered and supervised by Financial Services Authority (OJK), and also a participant of Indonesia Deposit Insurance Corporation (LPS) guarantee program.