In an extremely volatile market scenario, bonds, especially treasury bonds, and their stable and consistent returns often make them the preferred choice for investors. But are all bonds as completely secure investment options as they appear?

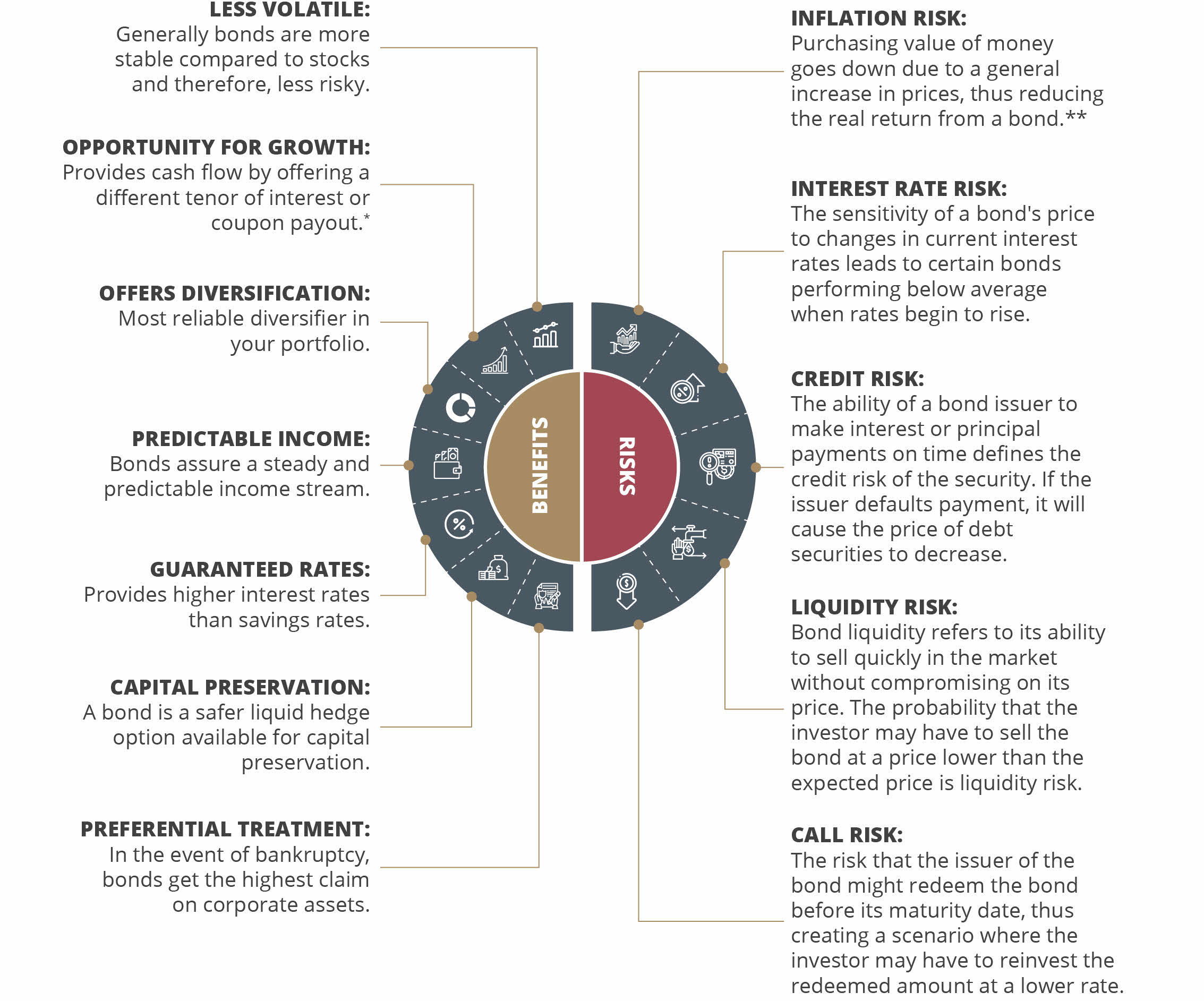

Benefits and Risks of Bonds

Bonds are a safer investment choice that help reduce your risk concentration in any one asset category. If you are accustomed to heavily investing in stocks, bonds are a good way to guard against market downturns and mitigating incurred losses. Here’s a quick overview of some of the benefits of holding a bond and potential risks associated with it that you should be wary about.

*More information in The Rewards & Risks of Buying Bonds

** If the inflation is 4% throughout the term of the bond with a nominal return of 5%, your wealth will relatively only grow by 1%. A lot of bonds today are indexed to inflation and thus protect your investment against inflationary tendencies.

Assessing Credit Risk

Assessing credit risk is important because there is always a possibility of credit default with fixed income investments. Credit risk can be of three forms:

-

Default risk is the issuer’s inability to meet its payment obligations.

-

Credit spread risk is usually associated with non-treasury bonds. The credit spread will increase when the default risk of a bond increases. This, in turn, increases the expected yield of the bond, which leads to a fall in the price of the

-

Downgrade risk occurs when an issuer’s creditworthiness declines.

Credit rating agencies such as Moody's Standard & Poor's, assign a credit rating after careful assessment of default risks of debts. These ratings reflect the credit quality of debts. Rated 'AAA' reflects high credit quality and consequently, very low credit risk. Rated 'CCC' reflects poor credit quality and high credit risk.

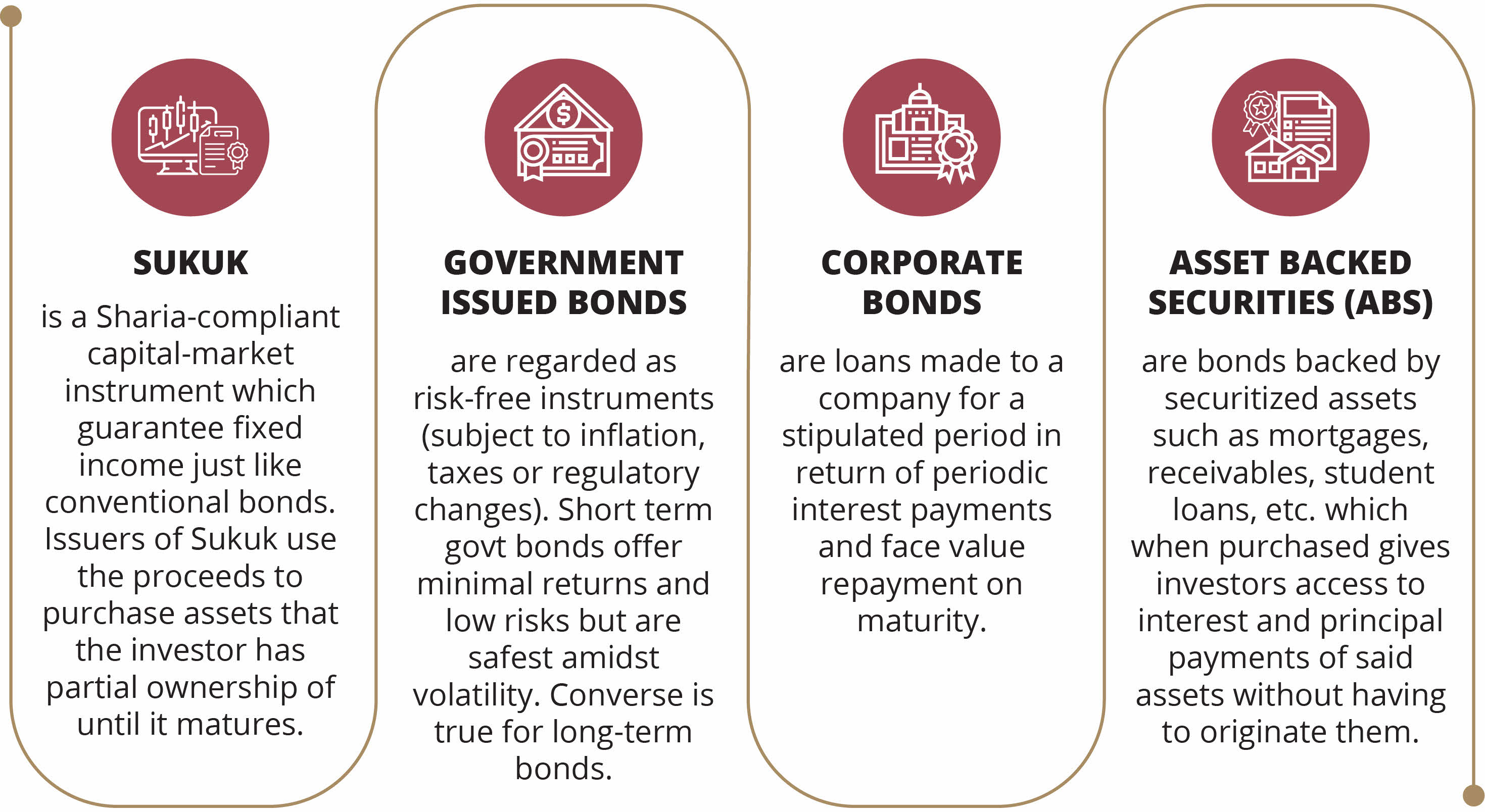

Which Bonds are Best for You?

In a nutshell

Bonds not only provide diversification but also help balance the volatility of other capital-market investments. While sovereign bonds have been generating higher returns in Indonesia over the past year compared to other emerging markets, it is advisable that before you build your portfolio, you keep yourself abreast of all market movements and the types of risks at play. This will help you decide whether to buy, hold, or sell a bond and in turn, contribute towards your wealth growth and management. For example, if the consensus in the market is that an interest rate hike is around the corner, it may be a signal for reducing explore to bonds. To hold a rate-sensitive bond when rates are going up might saddle you with losses. On the other hand, for low-interest rate environments, bonds may seem less lucrative than other asset classes. It is advisable to hold the bond and wait for the market to go green.

For more information on why you should hold bonds, read this article: The Rewards & Risks of Buying Bonds

If you have an interest in investment-grade or high-yield bond buying and selling that are not new issues and are available at a discount on the secondary market, you can learn more by discussing with the DBS Treasures team of experts. Note that there may be limited options in the secondary market and brokers may not be able to buy bonds directly.

Invest with DBS Treasures confidently through a comprehensive range of investment products, including Primary and Secondary Bonds. Enjoy easy Bond transactions in IDR or USD, available 24/7 through the digibank by DBS Application. Click below button to download and access digibank by DBS Application.