At a Glance

Secure your retirement comfort with passive income from Manulife Saving Plan Assurer.

Through one premium payment, get short-term life insurance protection and earn fixed income for 3 years.

Cash Payment Benefit is fixed amount

Single Premium and Affordable

starting at IDR10 million/USD1,000

Death Benefit 105% of Single Premium

Easy application without health check*

Product Feature and Benefits

Notes:

*Detail of term and conditions of this product is stated in Product Brochure click here

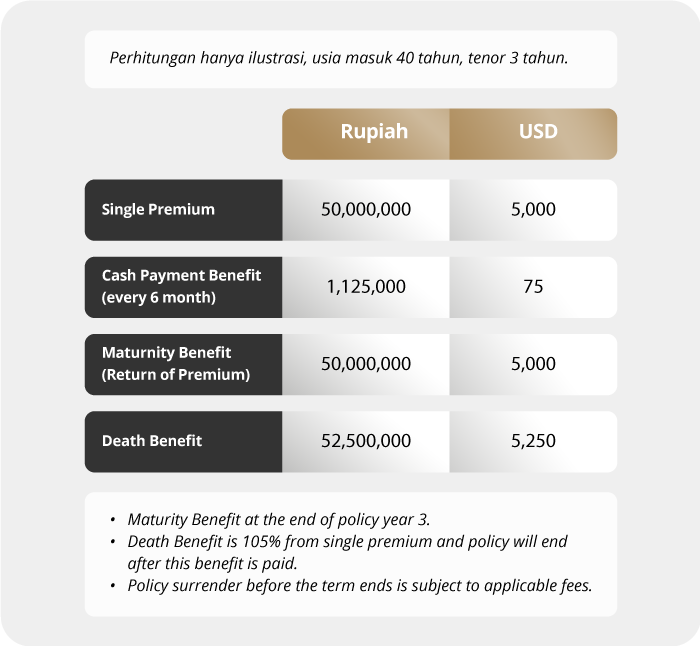

Illustration

Costs

All fees charged to customers will refer to the provisions of the Policy including but not limited to commission fees for the Bank.

Risks

Credit and Liquidity Risk

Policyholders will be exposed to the credit and liquidity PT Asuransi Jiwa Manulife Indonesia (“Manulife Indonesia”) risks of the Insurer as a risk selector of insurance products. Credit and liquidity risks relate to the ability to pay obligations by the Insurer to its customers, as well as the risk of default by the issuer of investment instruments.

Operational Risk

A risk caused by the failure or failure of internal processes, people, and systems, as well as by external events.

Foreign Exchange Rate Risk

Insurance Policies in foreign currency will be exposed to Exchange Rate Risk if the Policyholder/ Designated decides to convert the insurance benefits into local currency where the value depends on the foreign exchange rate at that time.

Early Termination Policy Risk

Early termination of the Policy may result in the Policy Value being less than the benefits paid (if any) or the premium paid and coverage will end.

IMPORTANT NOTE

Manulife Saving Plan Assurer (Manulife Saver) is an insurance product issued by Manulife Indonesia (licensed and supervised by OJK). This product is not a deposit product at PT Bank DBS Indonesia (the “Bank”) and therefore does not contain any obligations and is not guaranteed by the Bank and is not included in the government guarantee program implemented by the Deposit Insurance Corporation ("LPS").

The Bank only acts as the party that refers this product where the use of logos and/or other attributes in brochures or marketing documents is only a form of cooperation between the Bank and Manulife Indonesia therefore it cannot be interpreted that this product is a product of the Bank.

Please contact your Relationship Manager

Or visit the nearest DBS branch office.

Link Cepat

Butuh Bantuan?

Hubungi Spesialis kami

1 500 327 (hanya untuk nasabah Treasures) atau

+6221 298 52800 (luar negeri)

Atau kami akan menghubungi Anda