Unit Trusts help investors, including first-time investors, to diversify their investment portfolio and potentially secure long-term market outperformance on the road to reaching their financial goals. But there are other investment options in the market that are similar in nature - one commonly cited alternative is Exchange Traded Funds (ETFs).

Managed by professional fund managers, both UTs and ETFs promise investors lower inherent risks by offering a single solution that invests into different assets. ETFs may also offer cheaper management fees than UTs. So, what sets UTs apart and why can UTs be considered a better addition to investor portfolios?

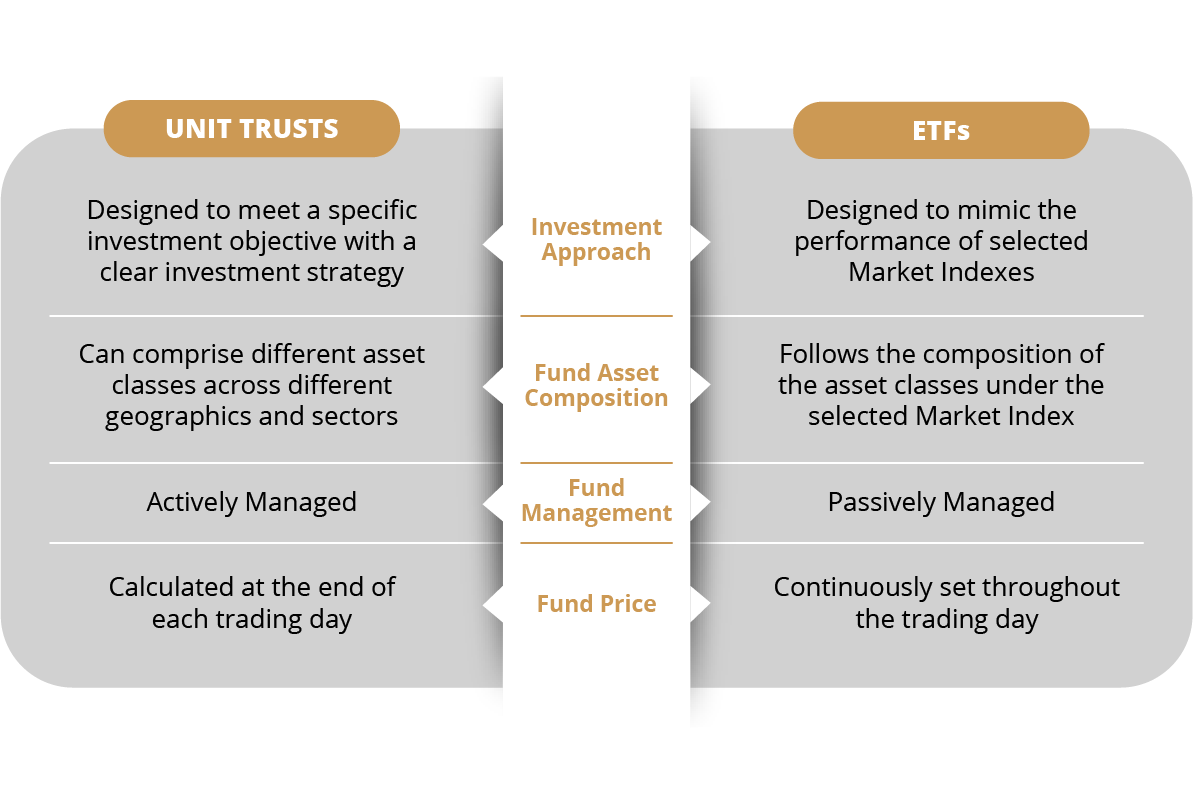

How do Unit Trusts differ from Exchange Traded Funds (ETFs)?

The DBS Advantage

There are different types of mutual fund investments for investors to choose from. Big cap and Small Mid Cap funds cater to investors with different investments convictions from a risk vs returns perspective. Offshore sharia stocks on the other hand enable investors to explore greater diversification opportunities. Here are more details about these funds:

Big Cap Funds: also known as blue chip fund Fund composed from a list of stocks categorized in first liner due huge market capitalization (above IDR 10 Trillion) and very liquid. These stocks are a prominent name in the market and apply good corporate governance. Most of the stocks have stable performance and profitability and usually pay the investor regular dividends.

Small Mid Cap Funds: also known as second liner fund Fund composed from a list of stocks categorized as second liner stocks that have market capitalization from IDR 500 Billion – IDR 10 Trillion. These stocks usually have a cheaper valuation compared to blue chip stocks and offer higher growth opportunity and price appreciation.

USD Based Equity: Offshore Sharia Fund composed from offshore stocks (outside Indonesia). They allow investors to invest in developed and emerging market stocks to capture the growth opportunity and diversification across the globe. Stock selection comply with the sharia principle and can be considered as a type of socially responsible investing.

But before you dive in and purchase Unit Trusts, it is important to know about investment strategy and why long-term planning can be profitable.

Allow DBS Treasures to help you find a fund that is best suited to your investment planning.