At a Glance

Lifetime monthly income*

Enjoy monthly income starting 3 years after premium paid fully.

Change of Insured facility*

Change the Insured up to 3 times.

Potential to earn attractive income.

Income consists of guaranteed income and additional income (if any).

Easily apply without Health check*

Product Feature and Benefits

Product Feature:

- Insured entry age from 1 month to 75 years old.

- Long term protection by referring age of the first Insured up to 120 years old.

- Change of Insured facility

- Available in IDR and USD currency.

- Premium Payment Period: Single Premium or Regular Premium (3 years, or 5 years)

- Complete your protection with optional rider MiPayor Benefit Plus

Product Benefit:

- Enjoy lifetime monthly income from the end of 37th, 61st or 85th Policy month* up to the first Insured is 120 years old.

- Maturity Benefit is 100% of Sum Insured, Additional Cash Value, and Cash Payment Benefit (if any)*.

- Death benefit is 105% of total Basic Premium paid, Additional Death Benefit (if any) and Cash Payment Benefit (if any)*.

Notes:

*The terms and conditions that apply to this product can be seen in the Product and Service Information Summary here

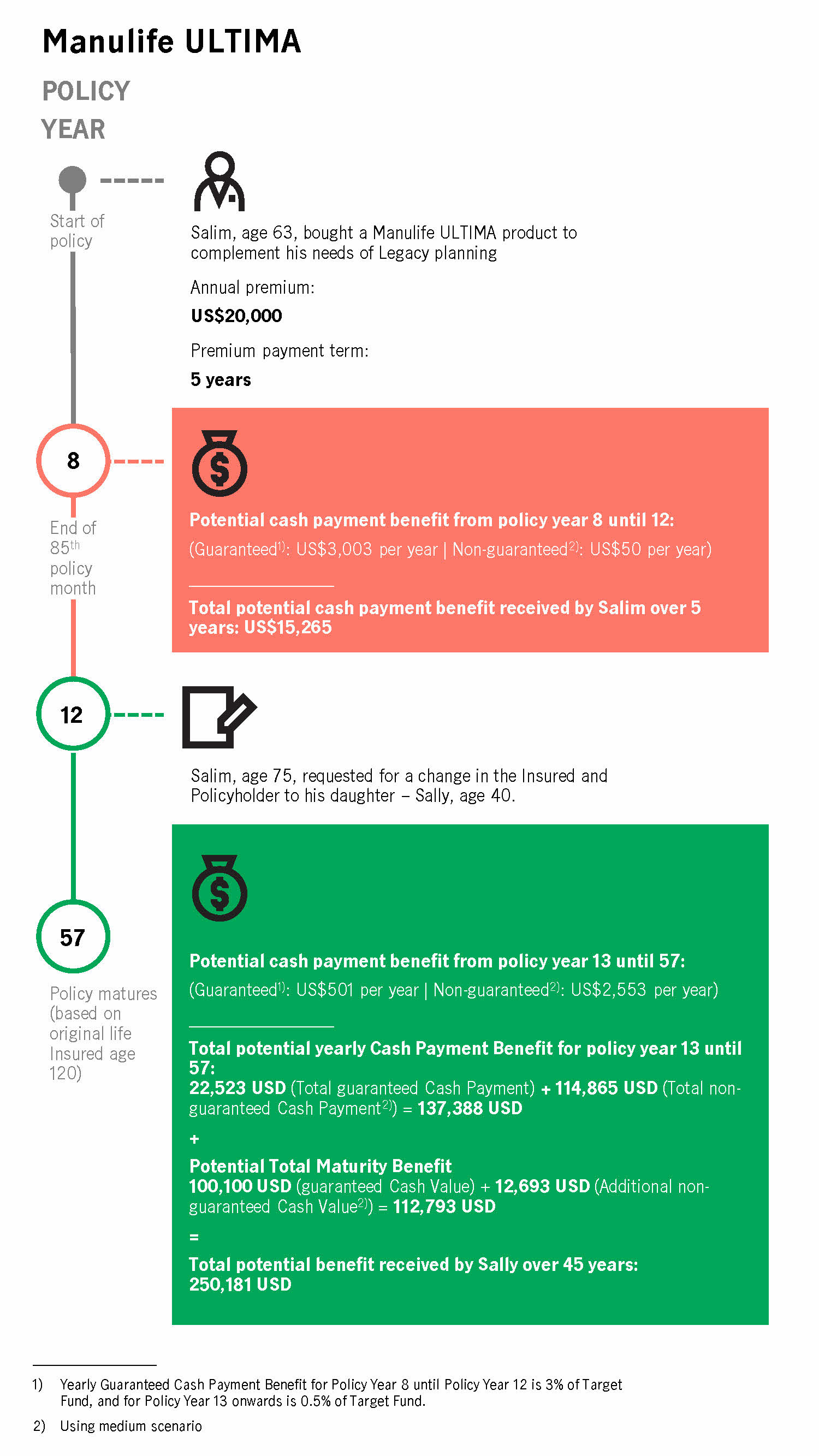

Illustrations

Costs

All fees charged to customers will refer to the provisions of the Policy including but not limited to commission fees for the Bank.

Risks

Credit and Liquidity Risk

Policyholders will be exposed to credit and liquidity risk of PT Asuransi Jiwa Manulife Indonesia (“Manulife Indonesia”) as the risk selector of insurance products. Credit and liquidity risk relates to the ability of Manulife Indonesia to pay its obligations to its customers, as well as the risk of default from the issuer of investment instruments.

Risk of Early Termination of Policy

Early termination of the Policy may result the Policy Cash Value being less than the Coverage Benefits that will be paid (if any) or the premiums that has been paid and the coverage will end.

Operational Risk

A risk caused by the failure of internal processes, people and systems, as well as by external events.

Foreign Exchange Rate Risk

Insurance Policies in foreign currency will be exposed to Exchange Rate Risk if the Policyholder/Designated decides to convert the insurance benefits into local currency where the value depends on the foreign exchange rate at that time.

Investment Risk

The investment returns obtained by participating funds may be lower than expected.

Insurance Risk

Death claims may be higher than expected.

IMPORTANT NOTE

Manulife Multigenerational Income Assurance (Manulife Ultima) is an insurance product issued by Manulife Indonesia (licensed and supervised by OJK). This product is not a deposit product at PT Bank DBS Indonesia (the “Bank”) and therefore does not contain any obligations and is not guaranteed by the Bank and is not included in the government guarantee program implemented by the Deposit Insurance Corporation ("LPS").

The Bank only acts as the party referencing this product where the use of logos and/or other attributes in brochures or marketing documents is only a form of cooperation between the Bank and Manulife Indonesia so it cannot be interpreted that this product is a product of the Bank.

Please contact your Relationship Manager

Or visit the nearest DBS branch office

Quick Links

Need Help?

Talk to a DBS Expert

1 500 327 or

+6221 29852800 (from outside Indonesia)

This number is not used for outgoing calls

Or have someone contact you