At a Glance

Higher Investment Allocation

Attractive Loyalty Benefit

Active Policy Guarantee* for the first 10 policy years

*Terms & conditions apply.

Features & Benefits

Features:

- Insured's entry age is 30 days - 70 years

- Minimum premium is Rp24,000,000/year or USD 8,000/year

- Flexibility to add additional protection (riders)

Main benefits:

-

105% investment allocation starting from year 1 to 7th of policy year.

-

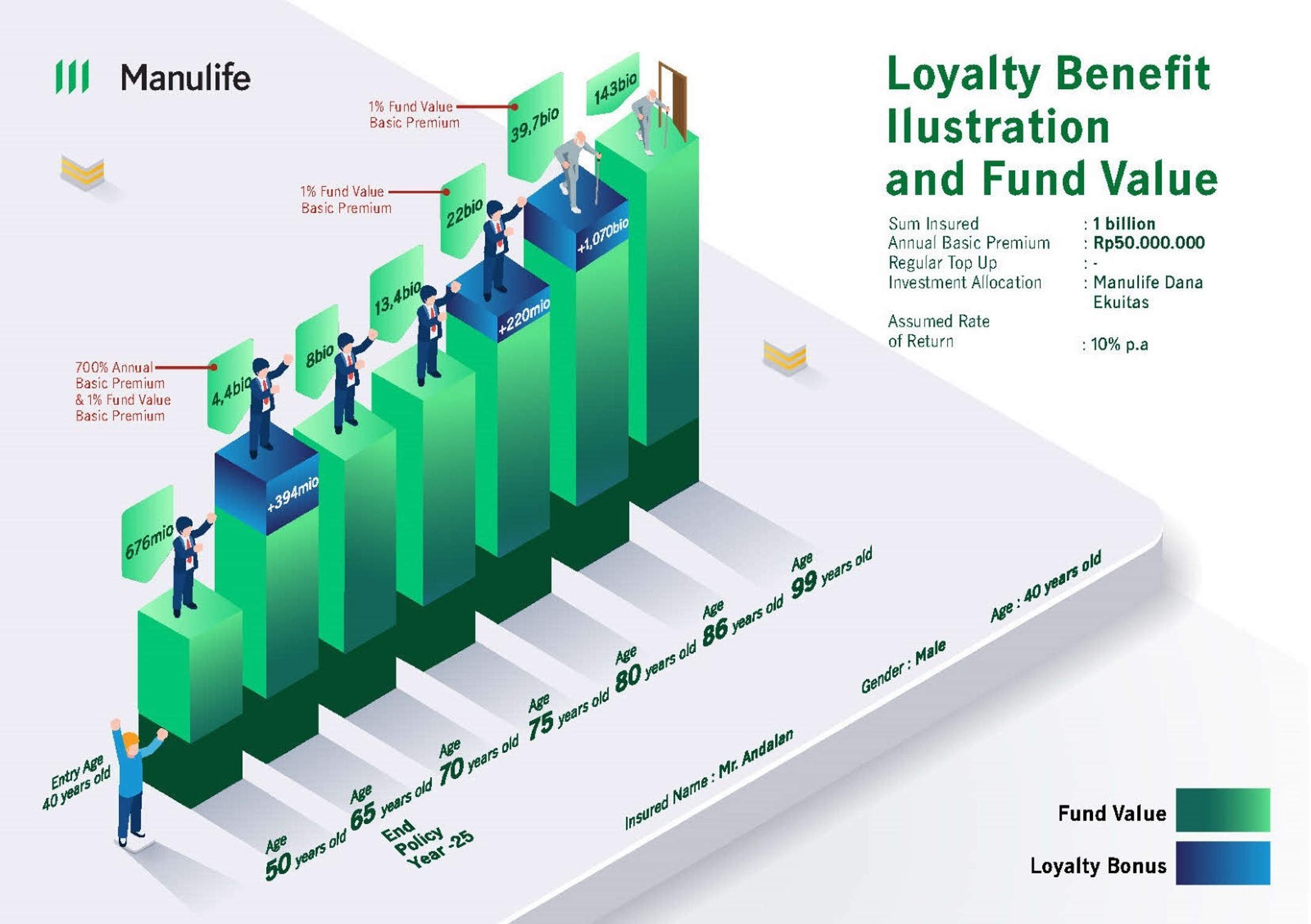

Loyalty benefit is 700% at the end of policy year 25 and 1% from basic premium policy starting from 25th policy year and given every 3 years*.

-

Free to choose the allocation of investment funds according to the risk profile of investors.

*Term and condition as stated in www.manulife.co.id.

.Find the Summary Product and Service Information here.

Illustration

- Policy value is not guaranteed to increase or decrease depending on the performance of the investment fund chosen by the customer and cannot be separated from investment risk.

- This illustration is not binding and does not constitute an insurance agreement or form part of the Policy. The rights and obligations as a Policy Holder/Insured and the provisions regarding this product are listed in the Policy. A more complete illustration of this product, both the premium to be paid, the sum assured, the assumed level of investment returns and so on are listed in the policy document.

Costs

-

Free of acquisition fees from the first year onwards.

-

Cost of Insurance are adjusted from the issuance of the Policy and are calculated based on the age of entry, gender, and the dynamic amount of the retirement benefit.

-

Administration fee of 5% per year, charged only for the first 7 years of the policy.

-

Top Up fee is 2% of each top up transaction.

-

Investment management fee of 1.25% to 2.5% per year of the total managed funds, depending on the selected investment fund. The Investment Fund is managed professionally by PT Asuransi Jiwa Manulife Indonesia (“Manulife Indonesia”). Manulife Indonesia has the right to outsource the management of investment funds to third parties in accordance with applicable regulations.

-

Withdrawal and/or cancellation of the unit will be charged at 95% in the first Policy year and will decrease gradually to 0% in the 8th Policy year.

-

All charges in full refer to the policy including but not limited to commission fees for bank

Risks

Market Risk

Unit prices will follow market price fluctuations. This will be seen in the volatility of the unit price and will cause the possibility of an increase or decrease in investment value.

Credit and Liquidity Risk

Policyholders will be exposed to Manulife Indonesia's Credit and Liquidity Risk as a risk selector for insurance products. Credit and Liquidity Risk relates to Manulife Indonesia's ability to pay obligations to its customers, as well as the risk of default from the issuer of investment instruments.

Operational Risk

A risk caused by the failure or failure of internal processes, people and systems, as well as by external events.

Exchange Rate Risk

Insurance policies in foreign currencies will be exposed to Exchange Rate Risk if the Policy Holder/Designated decides to convert the insurance benefits into local currency whose value depends on the foreign exchange rate at that time.

Unit Link Insurance Risk

The level of insurance risk for Unit Link products can be seen in the illustration proposals for Unit Link products or offer proposals that can be obtained from Marketers.

Early Termination of Policy

Early termination of the Policy may result in the Policy Value being less than the benefits paid (if any) or the premiums paid and the coverage ending.

IMPORTANT NOTE

MiTreasure Ultimate Protection is an insurance product issued by Manulife Indonesia. This product is not a deposit product at Bank DBS Indonesia and therefore does not contain any obligations and is not guaranteed by the bank and is not included in the government guarantee program of the Deposit Insurance Corporation ("LPS").

Bank DBS Indonesia only acts as the party referencing this product where the use of logos and/or other attributes in brochures or marketing documents is only a form of cooperation between Bank DBS Indonesia and Manulife Indonesia so it cannot be interpreted that this product is a product of Bank DBS Indonesia.

PT Bank DBS Indonesia and PT Asuransi Jiwa Manulife Indonesia are licensed and supervised by the Financial Services Authority (OJK).

Contact Us

Contact Us Our Relationship Manager will contact you for more further information.

Visit Us Find the nearest DBS branch in your town.

Related Topics

Quick Links

Need Help?

Talk to a DBS Expert

1 500 327 or

+6221 29852800 (from outside Indonesia)

Business Hours:

07.00 AM - 20.00 PM

Or have someone contact you