Key Points:

- Risk appetite is a measure of how much risk you are willing to take for potential returns.

- It’s important to choose investments that match your risk appetite for psychological comfort and to prepare for potential investment losses.

- Use the risk profile assessment feature in the digibank App to understand your risk appetite and find suitable investments for you.

Ready to invest with more confidence?

Investing can be an emotional journey as it involves the rewards of our hard work. That’s why, before starting your investment journey, it’s crucial to understand your risk appetite—how much risk you’re willing to take, how prepared you are to lose some or all of your capital, and whether you have the capacity to handle any losses.

Why does risk appetite matter?

Risk appetite is a measure of how much risk you are willing to take for returns. Some people are willing to take big risks, while others don’t want to lose any capital at all. It’s important to choose investments that match your risk appetite for psychological comfort and your ability to handle losses. Moreover, your investment horizon or time frame also affects your risk appetite.

How to Balance Risk and Return in Investments

While it may seem challenging to find the right mix of risk and return, digibank by DBS offers a simple risk assessment tool to help you get started. The main steps are:

Understand Your Risk Appetite

Open the digibank by DBS app, select the investment icon, and answer a few questions to assess your risk profile based on:

- Investment experience

- Ideal investment time frame

- Investment knowledge

- Capacity to bear capital loss

- Financial situation in the next 12 months

- Monthly income

The results will show your risk appetite, aligned with the desired potential returns.

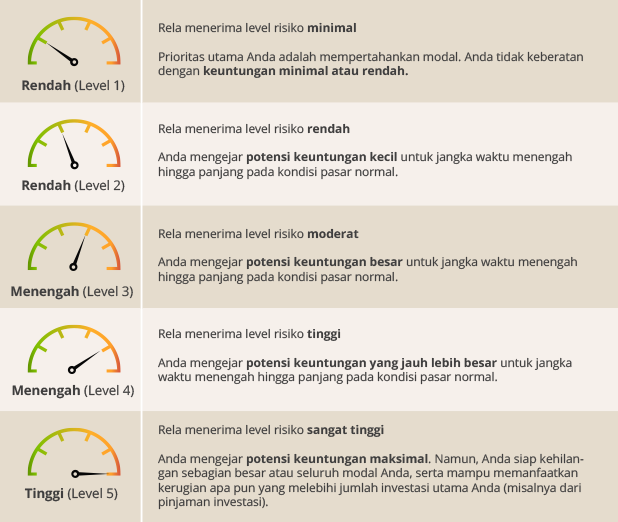

DBS Product Risk Rating

After identifying your risk profile and the product risk rating, you can use filters in the digibank app to find products that suit you. If you choose products with a risk score higher than recommended for your profile, you will be asked to confirm that you fully understand the risks.

Ready to get started?

With digibank by DBS, you can access expert investment recommendations and insights, with over 150+ curated products to help you navigate your investment journey, even amidst fluctuating interest rates, tailored to your financial goals and risk profile.

Contact us now!