Key Points:

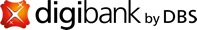

- Investing is a great way to protect the value of your money from inflation.

- Building a stable and diversified investment portfolio can maximize returns while keeping risks in check.

- Investment options to consider include bonds and mutual funds.

Want to invest confidently in any situation?

The average inflation rate in Indonesia over the past 20 years has reached 5.37%. With cumulative inflation over the next 20 years, the value of 1 billion Rupiah is projected to decrease to around Rp 543,478,260, meaning it will experience a value decline of approximately 45.7%

A good way to combat inflation is by building a stable investment portfolio that can maximize returns while managing risks. Diversification is also important so you can reduce the fluctuations in your portfolio.

Here are some types of investments you can use to protect your money from inflation:

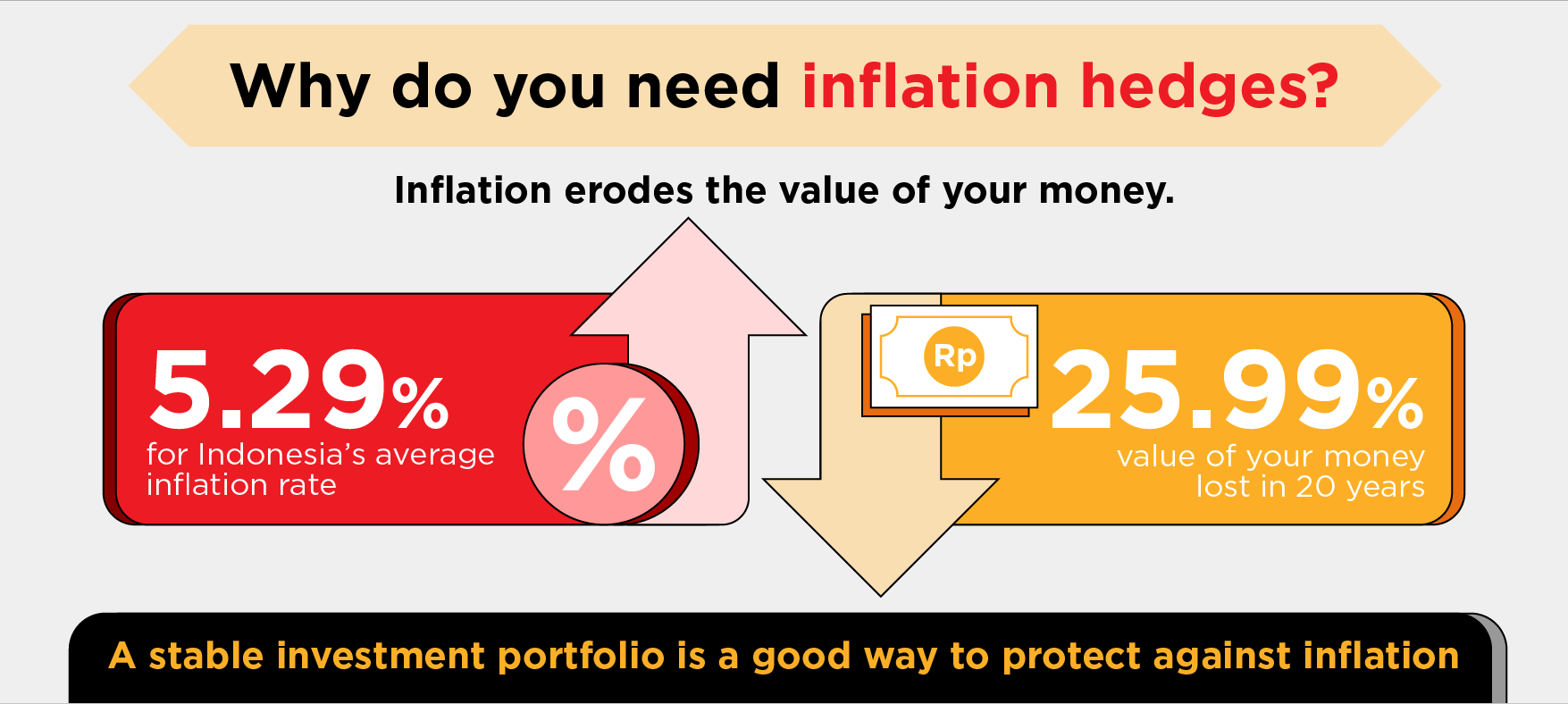

- Investing in Government Bonds

Government bonds, such as State Securities (SBN), can be an attractive option. The prices of bonds are affected by changes in interest rates. If interest rates rise, bond prices tend to fall, and vice versa. This can provide good insight and strategy when you want to trade bonds.

For example, if you buy SBN in October 2022 and hold it until maturity (say in 2025), you could earn a return of about 5.95%. In comparison, if you buy in October 2022 and sell the bond before 10 years, for instance in October 2030, you could achieve a higher return, possibly over 6.40% (depending on market value conditions).

Referring to S&P Global Ratings, an American credit rating agency and a division of S&P Global that publishes research and financial analysis related to stocks, bonds, and commodities, here are the ratings that can serve as a reference for assessing a bond.

However, an unrated bond does not mean that the issuing company is facing financial problems. Sometimes, companies are so confident that their bonds will sell well due to their brand name or reputation that they feel they don’t need to spend money on getting a credit rating.

In such cases, unless you can check the issuer's financial reports, earnings, cash flow, and future outlook yourself, you are actually taking a risk by lending money based only on their reputation, which may not reflect their actual financial condition.

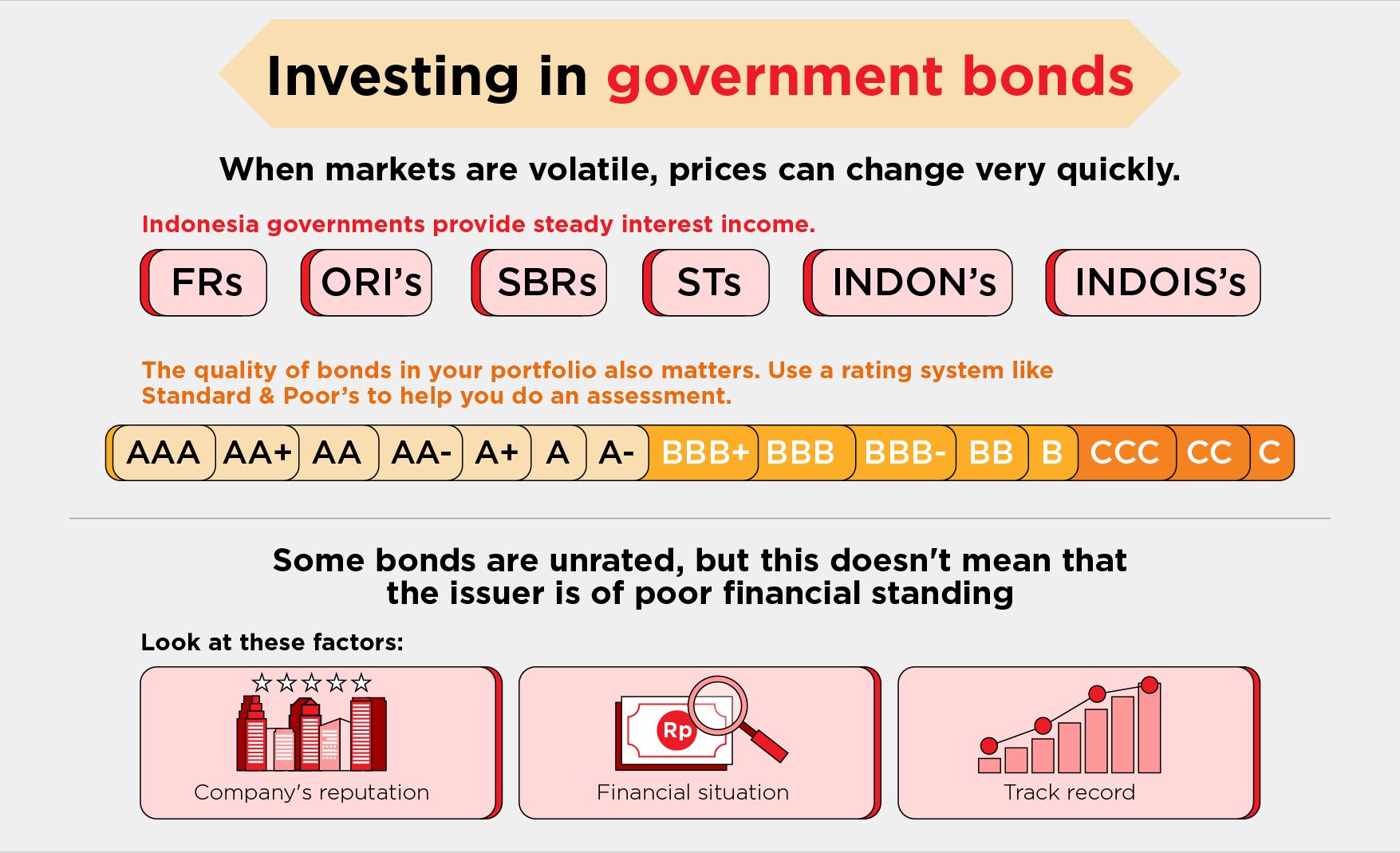

- Investing in Mutual Funds

Mutual funds, also known as unit trusts, allow you to earn returns when the market rises while minimizing risk. There are many mutual fund options that can be tailored to your risk profile and investment strategy.

Experienced fund managers will conduct thorough research before allocating your money into the asset classes you choose. They ensure that the mutual funds perform well compared to the market, enabling you to outpace inflation.

Invest with Confidence

Stay ahead of inflation with relevant insights and easy investment navigation. Guidance from the DBS expert team will support you through insights, analysis, and recommendations you receive.

Investing becomes easier with the digibank by DBS App. You can choose from over 150 curated investment products, ranging from mutual funds to bonds, along with personalized recommendations based on your risk profile, market conditions, and preferences. Let’s start investing now!