Beyond travelling and transacting on global payment platforms, experienced investors who manage their finances across multiple currencies understand that the uncertainty of fluctuating exchange rates

While there are some currencies that are considered relatively stable currencies, an open economy means that their value can still be affected by changes in the global market.

Many factors can impact a country’s / region’s currency. Whether it is an announcement of higher interest rates or an unstable political environment, a currency’s strength can change overnight.

Understanding these forces will help you take measures to protect the value of your investment against currency depreciation.

There are many ways of managing internationally spread money, so that you can gain from the dramatic swings of the currency market. Here are 3 ways you can work changes in currency rates to your advantage.

If you have plans to invest in a specific market, start keeping a lookout for favourable rates to build a portfolio in that market’s currency.

Take for example, investors going into the United States market should have taken advantage of the favourable rates when the IDR gained value (relative to the USD) in early 2020. Collection of the USD then would have helped them build up their funds and protect them against an unfavourable position when the USD gains ground again.

If you have specific currencies you use frequently, you can tap into good foreign currency rates to make the most out of your money.

Look at where you travel to frequently for business or holidays, or even where you favour online shopping at to identify and spot which currencies to hold.

Accumulating funds in the currency of the foreign market you are invested in when the rates are good can help you save on transactional costs.

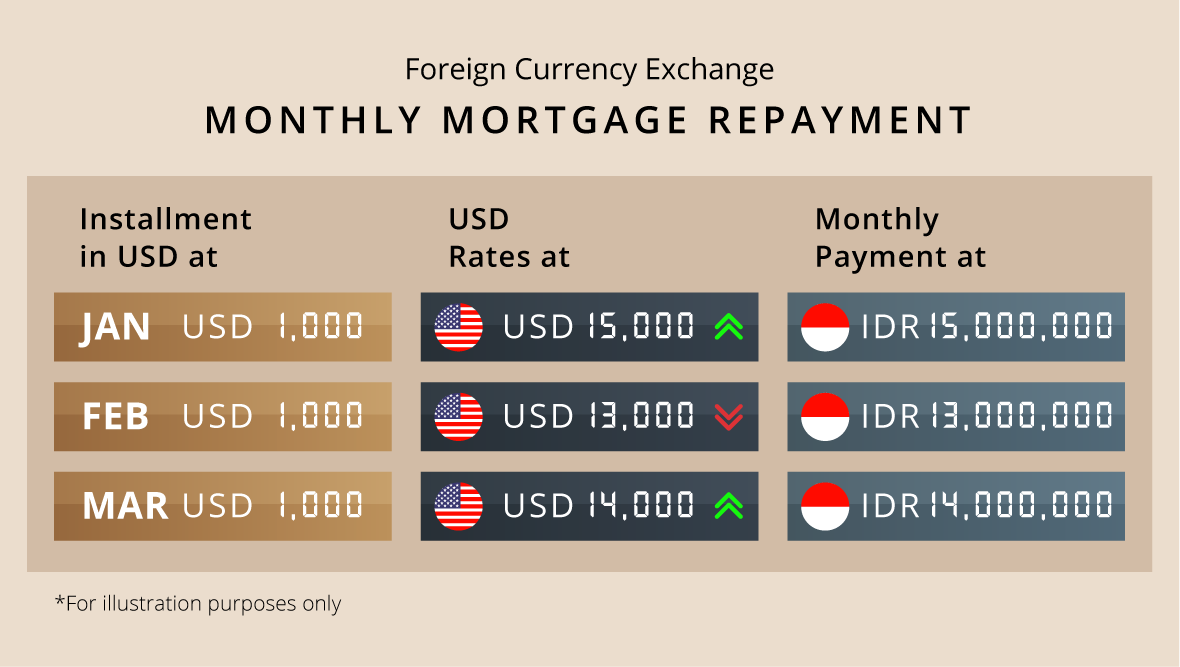

For instance, if you had a property overseas and had to service a fixed loan repayment every month, seizing good rates will help you avoid having to pay more when the exchange rate fluctuates.

A simple way to take advantage of favourable foreign currency rates is through a foreign currency mutual fund or simply buying and holding foreign currency.

Having a DBS Multi Currency Account allows you to hold different foreign currencies within the same account.

Remember it is all about timing when it comes to capturing good rates. Keep a lookout for the right moment to increase the real value of your funds.

with us for DBS Treasures comprehensive financial solutions

to enjoy the convenience of investment transactions in Rupiah and other Foreign Currencies