Related Insights

- CNY rates: New monetary policy tool 30 Oct 2024

- India rates: Near-term inflation to prove sticky 30 Oct 2024

- USD Rates: Hitting the pain threshold 30 Oct 2024

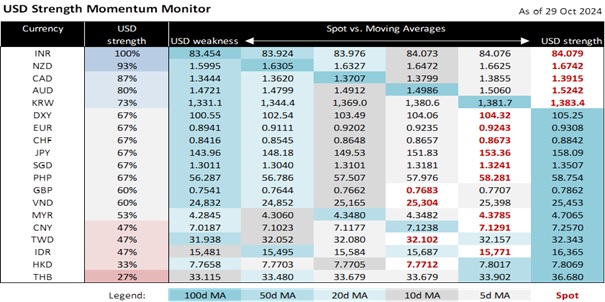

The DXY Index failed to close above 104.5 for a third time over the past week. Despite the best monthly gain in the US consumer confidence index since March 2021, the US Treasury 2Y yield fell for the first time in seven sessions by 4.1 bps to 4.096%. The Jobs Opening and Labor Turnover Survey (JOLTS) reported that job openings fell to 7.44 million in September, its worst level since January 2021. Given the Fed’s observation that fewer job vacancies led to higher unemployment rates, Fed should lower rates by 25 bps to 4.50-4.75% at next week’s FOMC meeting. Additionally, WTI crude oil prices fell 0.3% to USD67.20 per barrel, its lowest level since mid-September. Fears have subsided that the Israel-Iran conflict would not disrupt oil supply amid weak demand from China.

Today, US advance GDP growth is expected to moderate to an annualized 2.9% QoQ saar growth in 3Q24 from 3% in the previous quarter. The Atlanta Fed’s GDPNow projection fell to 2.8% yesterday from 3.3% last Friday. One possible reason could be the US trade deficit, which widened to USD305 bn in 3Q24, its largest since 2Q22. A drop in today’s ADP Employment to 111k in October from 143k in September should also embolden expectations for a similar decline in Friday’s nonfarm payrolls to 110k in October. We remain mindful that the DXY could reverse this recovery triggered by the surprise jump in payrolls to 254k in September.

GBP/USD rose 0.3% to 1.3015 ahead of today’s UK Budget announcement. With UK CPI inflation down from double-digit levels to below the 2% target, Chancellor of the Exchequer Rachel Reeves can pivot fiscal policy towards improving economic growth. The IMF has given implicit support for the UK to relax UK’s self-imposed fiscal rule to unleash public investment, namely in infrastructure, to achieve long-term growth. The Bank of England should also complement the Treasury’s effort by reducing monetary policy restriction next week with another 25 bps cut in the bank rate to 4.75%. The Office for Budget Responsibility (OBR) is also scheduled to report on the GBP22bn fiscal black hole left by from the Conservative Party, which Reeves is expected to more than offset with GBP40 bn of tax hikes and spending cuts. Hence, do not a repeat of the mini-budget crisis that hammered the GBP to a lifetime low in September 2022. This month’s drop in the GBP should be viewed as a correction after a three-month rally.

Quote of the Day

“Courage is not having the strength to go on, it is going on when you don’t have the strength.”

Theodore Roosevelt

October 30 in history

John L Loud patented the ballpoint pen in 1888.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.

Related Insights

- CNY rates: New monetary policy tool 30 Oct 2024

- India rates: Near-term inflation to prove sticky 30 Oct 2024

- USD Rates: Hitting the pain threshold 30 Oct 2024

Related Insights

- CNY rates: New monetary policy tool 30 Oct 2024

- India rates: Near-term inflation to prove sticky 30 Oct 2024

- USD Rates: Hitting the pain threshold 30 Oct 2024