- ECB cut rates amid disinflation, contracting manufacturing, and weak exports

- Corporate earnings are falling short of expectations with FY24 growth forecast cut to 1.8%

- Trade tariff negotiations add further headwinds to the region’s bleak growth outlook

- Maintain cautious stance on European markets amid economic headwinds and disappointing earnings

Bleak growth outlook. The European Central Bank (ECB) has cut its benchmark interest rates by 25 bps for the third time this year, bringing the deposit facility rate to 3.25%. The ongoing disinflationary trend was cited as the primary driver for the consecutive rate cuts. Driven by a sharper drop in energy prices and softer services inflation, Euro Area inflation continued its decline, falling below the ECB’s 2% target to 1.7% in September, down from 2.2% in August.

Meanwhile, the region’s Purchasing Managers' Index slipped into contractionary territory. Core member countries, particularly those heavily reliant on manufacturing, are grappling with a mix of challenges, including rising competition and sluggish demand for key exports such as automobiles and capital goods. This has resulted in a slower recovery in exports and dampened investment sentiment across the bloc. Notably, Germany, Europe’s largest economy, has downgraded its growth outlook, now forecasting a 0.2% contraction in 2024, a reversal from the previously expected 0.3% growth. This marks the second consecutive year of negative growth, following a 0.3% contraction in 2023.

In light of these developments, we have revised our rate cut projections, now anticipating an additional reduction in 4Q24, followed by further cuts in the first half of 2025 to bring the neutral rate to 2.0%. There are also growing discussions within the ECB on whether rates should be lowered below neutral to further stimulate the sluggish economy.

Earnings coming in short. Europe equities had a dismal start to October as the earnings season fell short of expectations, prompting downward revisions in forecasts. Of the 56 companies in the STOXX 600 that have reported earnings so far, 26 have missed expectations. As a result, the initial earnings growth forecast for FY24 has been slashed from 4.3% to 1.8%. Looking ahead, we anticipate that the 9% earnings growth forecast for next year will also be revised downward, given weak corporate guidance and ongoing headwinds from tariff negotiations.

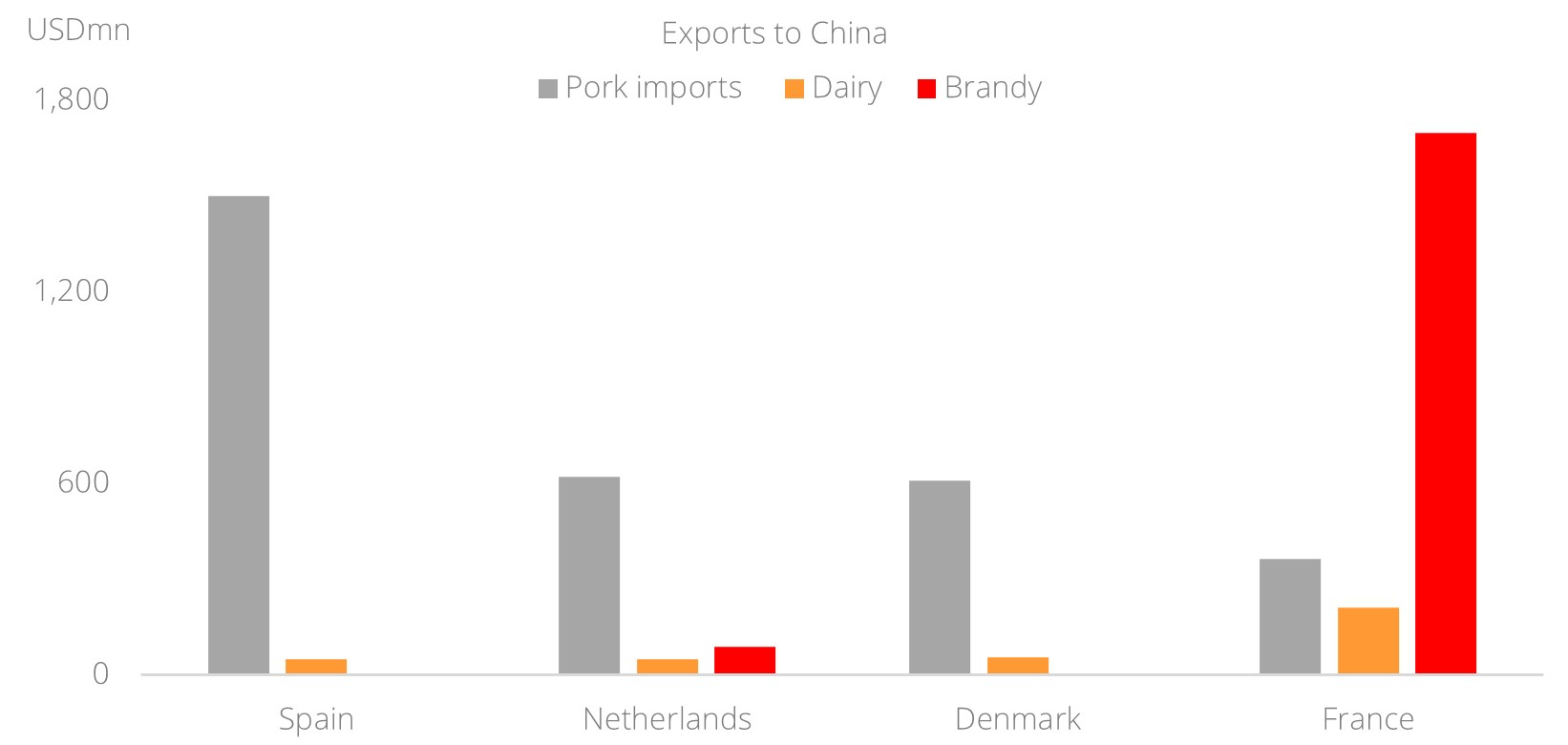

In response to the EU's decision to impose tariffs of up to 45% on Chinese-made electric vehicles (EVs), China's Ministry of Commerce has announced provisional anti-dumping measures on brandy imports from the EU. Additionally, China is conducting investigations into EU pork and dairy imports and is considering raising tariffs on imported large fuel vehicles. With China being EU's second largest trading partner, accounting for approximately 6% of total trade, these retaliatory actions are likely to create further challenges for European economies and corporations.

Source: Bloomberg, DBS

Delayed positive impact from China stimulus. China is a crucial market for many European industries. While Beijing's recent announcements of large-scale stimulus measures ignited some optimism, the lack of specificities has left uncertainty on whether China can restart its growth engine. Furthermore, overhang from China-Europe trade tariffs, coupled with US restrictions on technology exports to China, are likely to delay positive repercussions.

French luxury giant LVMH reported weak quarterly sales, primarily driven by sluggish demand in China. Although semiconductor equipment maker ASML exceeded earnings expectations, it issued a cautious outlook due to the uncertain environment. According to calculations from Reuters data, approximately 10% of European corporate earnings are derived from China/Asia, underscoring the region's importance in contributing to Europe's economic fortunes.

Energy prices a concern for the region. Ongoing turmoil in the Middle East is adding to volatility in energy markets with concerns mounting over potential threats to critical energy infrastructure in the region. As supply risks increase and climate uncertainties persist, the upcoming winter season could drive energy prices higher. This poses a significant risk to the global disinflationary trend and could limit the ECB's ability to implement further rate cuts which are crucial for supporting the region’s slowing economy.

Given these challenges, we maintain a cautious stance on European markets, particularly in light of economic headwinds and disappointing corporate earnings. However, we remain optimistic about long-term structural themes with quiet luxury, technology, and healthcare continuing to be our investment preferences, while renewables present fresh opportunities.

Download the PDF to read the full report.

Topic

Explore more

CIO PerspectivesThis information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

The information contained in this article has been obtained from sources believed to be reliable, but DBS makes no representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.

Please refer to the Additional Terms and Conditions Governing Digital Tokens for DBS Treasures Customers for more specific risk disclosures on trading of digital tokens.

This information does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or enter into any transaction. It does not have regard to your specific investment objectives, financial situation or particular needs. It is not intended to provide, and should not be relied upon for accounting, legal or tax advice.

Cryptocurrency trading is highly risky and prices can be very volatile. All investments come with risks and you can lose your entire investment. Before you decide to purchase an investment product, you should read all the relevant documents and carefully assess if it is suitable for you. Invest only if you understand and can monitor your investmen. Diversify your investments and avoid investing a large portion of your money in a single asset type.

Trading in Cryptocurrencies or the instrument (“Instrument”), such as ETF, referencing or with underlying as Cryptocurrencies ("Crypto-Products”), such as Bitcoin ETFs, is highly risky and prices can be very volatile. All investments come with risks and you can lose your entire investment. By trading in Crypto-Products, you are exposed to the risks of both the Instrument and the Cryptocurrencies. Further, Crypto-Products listed on overseas exchanges may not be regulated in Singapore, and are subject to the laws and regulations of the jurisdiction it is listed in. Before you decide to buy or sell Cryptocurrencies or Crypto-Products, you should read all the relevant documents and carefully assess if it is suitable for you and/or seek advice from a financial adviser regarding its suitability. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single asset type.

To the extent permitted by law, DBS accepts no liability whatsoever for any direct, indirect or consequential losses or damages arising from or in connection with the use or reliance of this email or its contents. If this information has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses.

Please refer to Terms and Conditions governing your banking relationship with DBS for more specific risk disclosures on the Instrument (such as ETFs under Funds) and Digital Tokens.

This information is provided to you as an “Accredited Investor” (defined under the Securities and Futures Act of Singapore and the Securities and Futures (Classes of Investors) Regulations 2018) for your private use only. It is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation, and may not be passed on or disclosed to any person nor copied or reproduced in any manner.

DBS (Company Registration. No. 196800306E) is an Exempt Financial Adviser as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore (the "MAS")