Related Insights

- Thematic Strategy 1Q26 - The Longevity Economy22 Dec 2025

- CIO Insights 1Q26: The Long Game22 Dec 2025

- Alternatives 1Q26 - Finding True Diversification19 Dec 2025

Key Points:

- Rather than predicting the US election, it's important to consider the implications to government under Trump 2.0 or Harris 1.0. Both will likely favour a tough China stance and defence spending. Historically, markets perform well post-election. The next president will face three challenges: Fed rate-cutting cycle, high federal debt, and slowing GDP growth, projected to hit 1.7% in 2025.

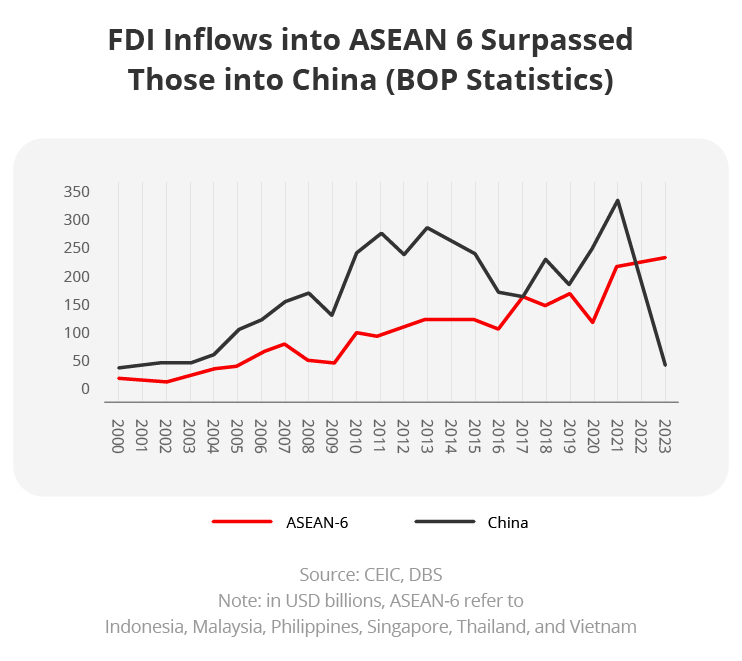

- The China +1 strategy is gaining traction amid US-China tensions, helping companies reduce reliance on China while tapping into ASEAN’s growth potential. ASEAN has seen higher FDI inflows than China recently, driven by lower labour costs, efficient supply chains, and government incentives. The region also offers favourable regulatory conditions, with few restrictions on foreign investment outside critical sectors such as finance and telecom.

US Presidential Elections

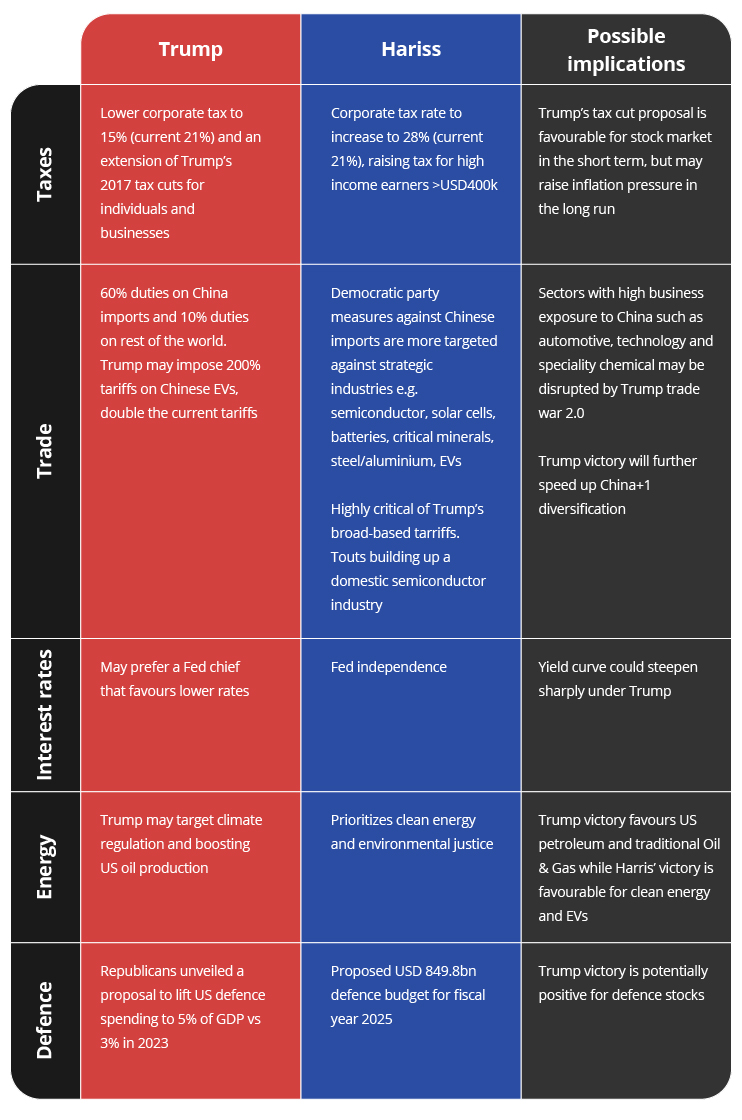

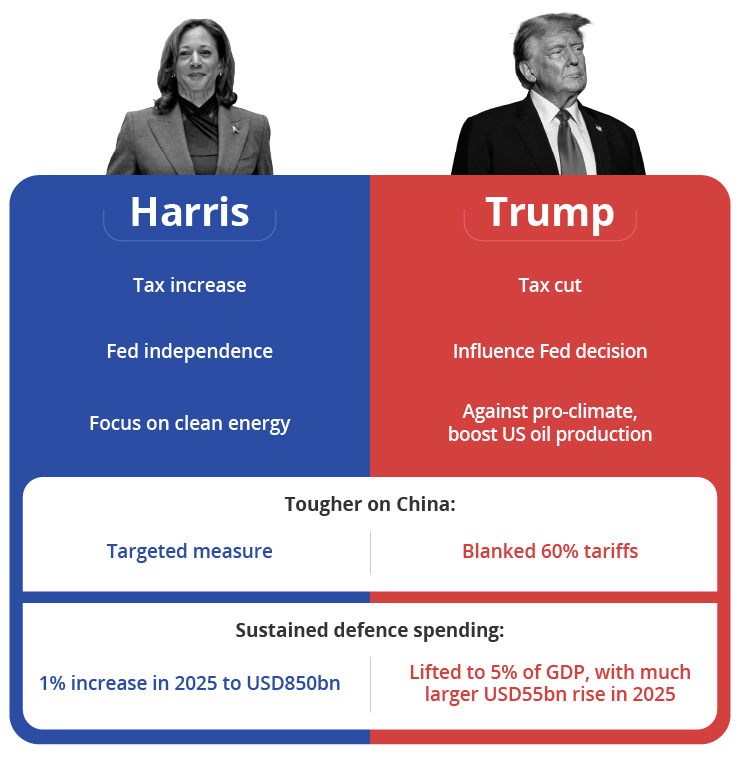

It’s a neck-and-neck race. We prefer to look at the possible implications under Trump 2.0 and Harris 1.0 rather than anticipating the outcome of the US Presidential Election. The rhetoric of 1) taking a hard stance on China, and 2) sustaining defence spending stand out as two common themes amid the opposing views on many other topics (e.g. taxes, tariffs, energy).

Possible Implications based on Current Front-runner Candidates

Harris and Trump Overlapping Policies: Tougher on China and Higher Defence Spending

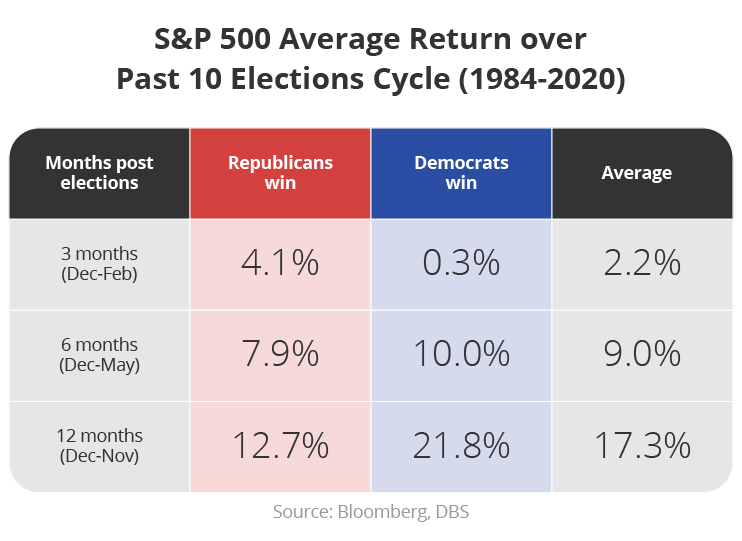

Markets often do well post elections, regardless of the outcome. Over the past 10 US elections cycles (from 1984 to 2020), the S&P 500 Index delivered average price returns of 2.2% (3 months), 9.0% (6 months), and 17.3% (12 months) after elections.

Three macro considerations that the new president needs to deal with:

- The next term will begin during a Fed rate-cutting cycle, not a hiking cycle.

- The massive federal debt accumulated during the last two presidential terms will limit the ability to stimulate the US economy.

- US GDP growth is expected to slow to 1.7% in 2025 from 2.3% in 2024, according to our DBS economists forecast.

US Presidential Election Winners/Losers – China + 1 the Only Constant

The ongoing China +1 trade diversification strategy is likely to gain more traction, with the US-China tensions unlikely to subside with this election. This strategy helps companies to 1) mitigate the risks of overconcentration on a single market; and 2) capitalize on attractive growth prospects and opportunities especially in the ASEAN region.

ASEAN remains as an attractive region for expansion. FDI inflows into ASEAN 6 have outpaced that into China over the past 2 years, which suggests actual diversion of resources away from China into this region by businesses/investors.

Most ASEAN countries also offer 1) relatively lower labour cost, 2) efficient supply chain given proximity to China and the regional markets, and/or 3) government subsidies to entice investments. Regulatory conditions across ASEAN countries are also conducive. In general, there are no restrictions on foreign investment, except from selected critical industries such as financial services, telecommunications, and media.

Be it Trump 2.0 or Harris 1.0, the ongoing China +1 trade diversification strategy is likely to gain more traction as the US-China tensions are unlikely to subside post-election. Trump is targeting 60% blanket tariffs while Harris seeks targeted measures on Chinese imports. Companies will continue to mitigate the risks of over-concentration on China as well as capitalize on attractive growth prospects and opportunities especially in the ASEAN region.

Seize the opportunity on the digibank by DBS Application.

Discuss your wealth management strategy.

Find the latest insights analysed by DBS experts.

DISCLAIMER

This publication is distributed by PT Bank DBS Indonesia (DBSI). DBSI is licensed and supervised by the Indonesia Financial Services Authority (OJK). This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

Topic

Explore more

CIO InsightsRelated Insights

- Thematic Strategy 1Q26 - The Longevity Economy22 Dec 2025

- CIO Insights 1Q26: The Long Game22 Dec 2025

- Alternatives 1Q26 - Finding True Diversification19 Dec 2025

Related Insights

- Thematic Strategy 1Q26 - The Longevity Economy22 Dec 2025

- CIO Insights 1Q26: The Long Game22 Dec 2025

- Alternatives 1Q26 - Finding True Diversification19 Dec 2025