- Lower valuations and potential for IRR uplift present a compelling entry point for PE investors

- Co-investments offer control over PE portfolio construction and flexibility to adjust strategy

- Demonstrated IRR outperformance during periods of uncertainty; significant downside attenuation

- Lower fees and carried interest play a key role in generating higher returns for investors

- Co-investing involves navigating key risks; Careful GP selection and thorough due diligence needed

Related Insights

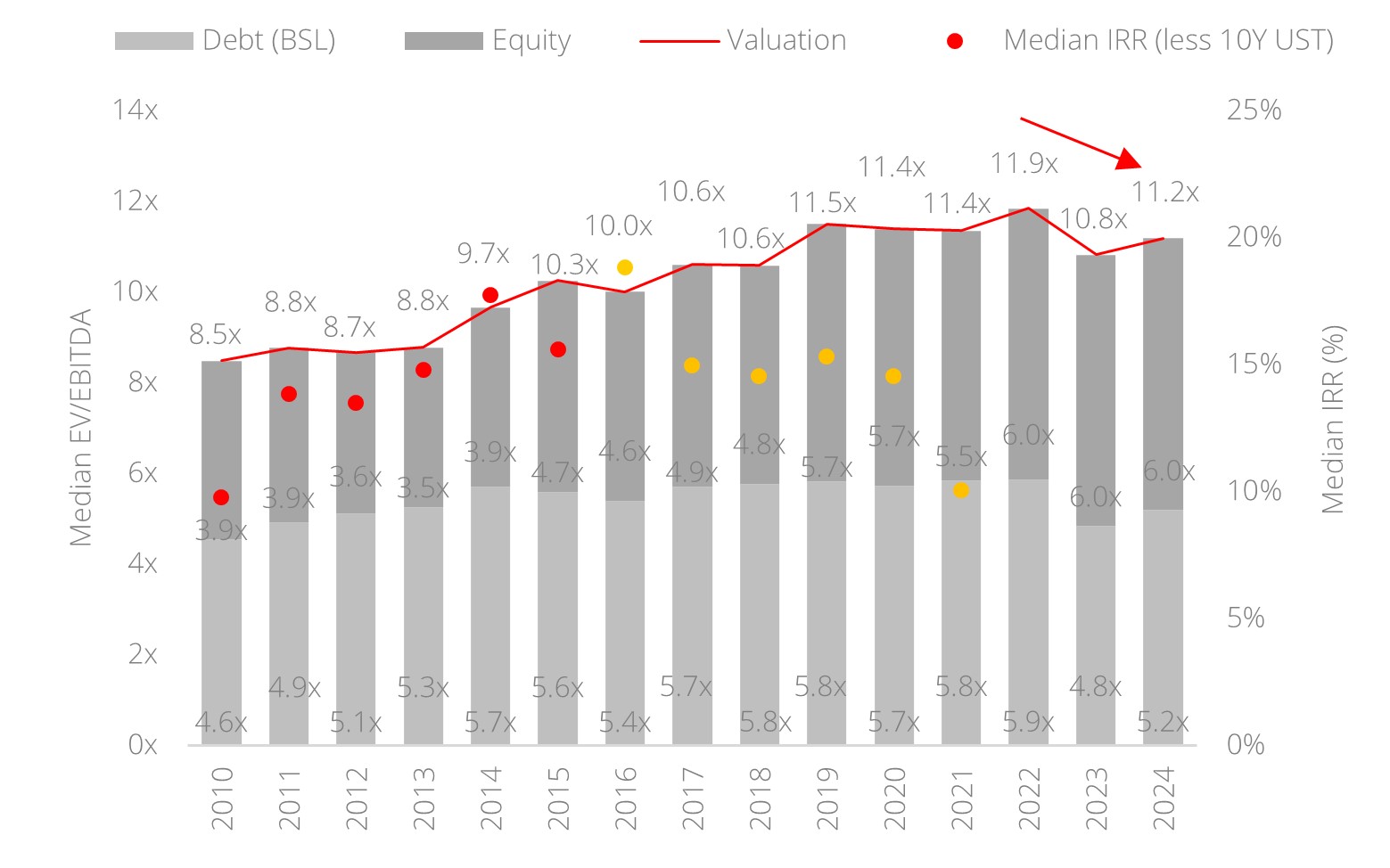

Cheaper at the horizon. Interest rate hikes in the 2022 Fed tightening cycle, and subsequent bouts of public market corrections, precipitated a dip in private equity valuation multiples to 10.8x in 2023, down from the post-GFC (Global Financial Crisis) peak of 11.9x in 2022 – the first downward adjustment in more than a decade. Lower valuations such as these present attractive opportunities for buyers, offering not only cheaper entry points, but also the potential for internal rate of return (IRR) recovery when market conditions improve, especially as the Fed has embarked on a rate cutting cycle.

Figure 1: Downward-adjusted valuations avail lower entry points for private equity investors

Source: Pitchbook, DBS

Note: Yellow markings denote vintages with majority unrealised returns.

Multiples data was as at Jun 2024

Co-investments to the fore. The prospect of amenable valuations and IRR uplift in private equity compels the careful selection of private equity access points to reap the most reward in a timely manner. While primary funds provide a foundational and diversified entry to private equity and are naturally the first access point that comes to mind, investors do not gain immediate exposure to underlying assets at prevailing market conditions due to early-stage expenses, and take longer to reach positive returns on committed capital.

Co-investments are spin-offs from the primary fund investing model and offer investors the opportunity to invest alongside General Partners (GPs) outside of the aforementioned primary fund commitment structure. Typically, GPs offering co-investments opportunities have already examined the underlying investments, negotiated the terms of the transactions, and are in the process of closing the investment, but require a larger check than they are momentarily able to write. Co-investors fill the funding gap, and in the process, ride on the GPs’ expertise in deal sourcing, due diligence, and diversification, at an attenuated fee compared to primary fund investors. This arrangement, however, only gets co-investors a minority stake in underlying target portfolio companies. Nevertheless, the arrangement confers co-investors the ability to accelerate their capital deployment into the asset class, and at the prevailing market conditions. Such control over private equity portfolio is paramount. When market environments are favourable, co-investments can be used to build private equity exposure quickly. When valuations become stretched, however, co-investors have the flexibility to taper deployment.

Outperformance more than meets the eye. A comparison of median net IRR of primary funds and co-investments highlight the outperformance of co-investments, which interestingly persisted across bouts of macroeconomic uncertainty since the GFC. The outperformance in net IRR over primary funds during key macroeconomic disruptions from 2017 to 2023, in particular, were in spite of rising private equity valuations, suggesting that the differentiating edge of co-investments likely goes beyond mere enhancements in deal selectivity.

The “fee” advantage. In contrast to primary funds which display a flat management fee and carried interest structure, co-investments show a dynamic management fee and carried interest profile which appears to adjust in response to macroeconomic conditions. At the dawn of the Covid-19 pandemic, carried interest for primary funds were fixed at 20% whereas that for co-investments were down-adjusted three-fold and reached 10%. Similarly, management fees for co-investments tapered down to 1% ahead of the 2022 Fed tightening cycle, whereas that of primary funds remain fixed at 2% (Figure 4). The stark differences in fees and carried interest between primary funds and co-investments during macroeconomic disruptions likely contributed significantly to the IRR disparities observed (Figure 3).

Lower fees pay off. To illustrate the impact of lower fees and carried interest on relative performance, we ran a hypothetical capital distribution model (Figure 5) fitted with median fee values (from Figure 4) under the assumption of 2.0x gross returns for both co-investment and primary funds over a seven-year horizon. The reduction in GP costs led to a 16% increase in net performance for the Limited Partner (LP) in the co-investment program.

All that glitters is gold. Having elucidated the role of lower fees on the outperformance of co-investments over primary funds, we proceeded to examine the downsides of co-investments by generating a probability distribution model of total value paid-in (TVPI) multiples based on 5,000 simulations of sample baskets containing co-investments and primary funds. The model reveals the probabilities of 5.3% and 10.9% for TVPI to dip below 1.00x in co-investments, and primary funds investing, respectively. This suggests that co-investments offer some downside attenuation compared to primary fund investments.

Making a foray into co-investments. Co-investing offers unique opportunities but also presents specific risks that investors must navigate carefully. Uncertainty in the deal pipeline often means that co-investors cannot predict the quality of upcoming deals. This necessitates well-resourced and experienced teams to conduct thorough evaluations as and when opportunities arise. Additionally, compressed response times for co-investments (often closing in a matter of days to weeks) increase the risk of inadequate due diligence. Investors need to be mindful to prioritise rigour above agility to uphold due diligence standards despite time constraints. Next, adverse selection – the risk of GPs offering less attractive deals to co-investors and reserving stronger opportunities for their flagship funds – can result in co-investors allocating disproportionately into deals with high chance of underperformance. This risk may be mitigated by working with reputable GPs who are motivated to offer quality deals to co-investors to foster meaningful long-term relationships. Finally, GPs vary widely in transparency and reporting practices. Working with GPs who are committed to providing comprehensive due diligence materials and consistent performance reporting is paramount.

Download the PDF to read the full report.

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

The information contained in this article has been obtained from sources believed to be reliable, but DBS makes no representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.

Please refer to the Additional Terms and Conditions Governing Digital Tokens for DBS Treasures Customers for more specific risk disclosures on trading of digital tokens.

This information does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or enter into any transaction. It does not have regard to your specific investment objectives, financial situation or particular needs. It is not intended to provide, and should not be relied upon for accounting, legal or tax advice.

Cryptocurrency trading is highly risky and prices can be very volatile. All investments come with risks and you can lose your entire investment. Before you decide to purchase an investment product, you should read all the relevant documents and carefully assess if it is suitable for you. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single asset type.

Trading in Cryptocurrencies or the instrument (“Instrument”), such as ETF, referencing or with underlying as Cryptocurrencies ("Crypto-Products”), such as Bitcoin ETFs, is highly risky and prices can be very volatile. All investments come with risks and you can lose your entire investment. By trading in Crypto-Products, you are exposed to the risks of both the Instrument and the Cryptocurrencies. Further, Crypto-Products listed on overseas exchanges may not be regulated in Singapore, and are subject to the laws and regulations of the jurisdiction it is listed in. Before you decide to buy or sell Cryptocurrencies or Crypto-Products, you should read all the relevant documents and carefully assess if it is suitable for you and/or seek advice from a financial adviser regarding its suitability. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single asset type.

To the extent permitted by law, DBS accepts no liability whatsoever for any direct, indirect or consequential losses or damages arising from or in connection with the use or reliance of this email or its contents. If this information has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses.

Please refer to Terms and Conditions governing your banking relationship with DBS for more specific risk disclosures on the Instrument (such as ETFs under Funds) and Digital Tokens.

This information is provided to you as an “Accredited Investor” (defined under the Securities and Futures Act of Singapore and the Securities and Futures (Classes of Investors) Regulations 2018) for your private use only. It is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation, and may not be passed on or disclosed to any person nor copied or reproduced in any manner.

DBS (Company Registration. No. 196800306E) is an Exempt Financial Adviser as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore (the "MAS")