- US wage growth remains sticky despite Fed monetary tightening

- Wage stickiness translates to margin pressure & weaker earnings momentum for companies

- Navigate wage stickiness- seek exposure in companies that can on-pass rising cost to customers

- Navigate higher for longer rates- seek exposure to Financials. quality growth equities & IG bonds

- Avoid highly leveraged companies

Related Insights

Demystifying the resilience of US wage growth. The stickiness of US wages has confounded economists. Despite acute monetary tightening by the Fed, wage growth has remained elevated at the c.5% range, underpinning overall inflationary pressure in the US. We believe that this anomaly could be attributed to the following:

- Rise in onshoring as a result of trade wars and rising production costs in China

- Covid pandemic leading to jobs mismatch as companies struggle to rehire

- Rising minimum wages in the US with 26 states slated to introduce higher minimum wages this year

The persistence of these factors suggest that US wage growth will stay higher for longer and this view is reaffirmed by leading indicators like the NFIB Small Business Jobs Opening (hard to fill) and NFIB Small Business Compensation Plan indices, both of which are pointing to further upside in wages.

In order for wage growth to revert to the long-term average of 2.6%, our regression study suggests that an unemployment rate of 5.9% will be necessary and this is 2.3%pts higher than the current level. But given the prevalence of low unemployment rates, wage pressure in the US is here to stay.

Fed policy rate to stay higher for longer; terminal rate at 5.25%. The current situation puts the Fed in a conundrum. With inflation (both headline and core) and retail sales numbers coming in stronger than expected in January, the US central bank will have no choice but to keep rates higher for longer.

Recent sell-offs in US 10Y treasuries show that the rates market is already pricing-in higher terminal rates and a postponement of Fed rates cuts to 2024. We concur and are now expecting a terminal rate of 5.25% and for rate cuts to be capped at 100 bps during 2H24.

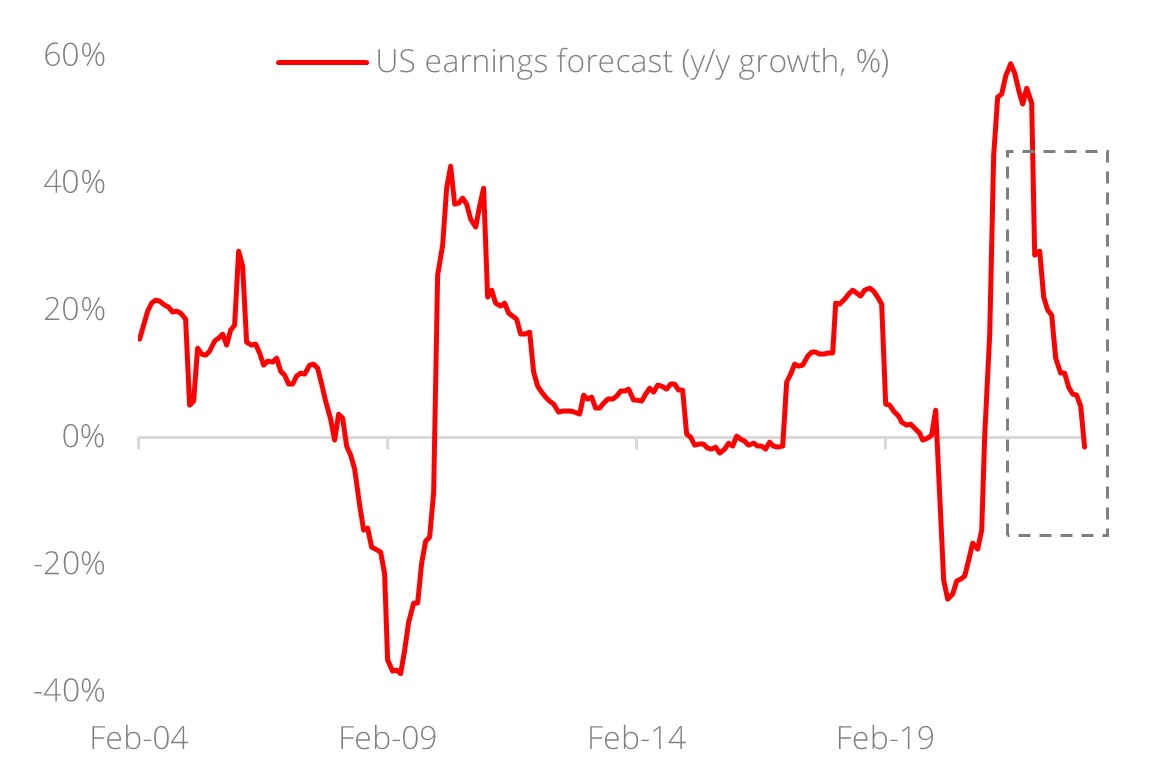

Margin pressure and rising earnings recession risk. The stickiness in wages results in margin compression for US companies. Since February 2022, operating margins have contracted 2.1%pts and inevitably, this translates to weakening earnings momentum for the broader market, for instance:

- Consensus is expecting earnings decline of 1.1% in 2023; more cuts are likely should macro momentum moderate while operating cost stays elevated

- Negative earnings surprise has surged 12.6%pts since 2021 and breached the +1 standard deviation mark

Figure 1: Rising earnings recession risk

Source: Bloomberg, DBS

Seek resilience in equity exposure. Sticky wages and elevated bond yields could pose substantial headwinds to equities in the coming months and our strategies are:

- Navigating wage stickiness: Gain exposure to companies that can on-pass rising operating cost to end customers via higher ASPs. These companies either (a) operate in the necessities space or (b) possess strong brand franchises. Examples of such companies include luxury brands or companies with moat of high switching costs.

- Navigating higher for longer rates: Higher bond yields is positive for the Financials sector and negative for highly leveraged companies. Meanwhile, the common assumption that rising bond yields is negative for growth equities (such as Technology) is inconclusive as the prevailing valuation has already reflected much of the downside. Seek elective exposure in quality growth equities and IG bonds.

To view more takeaways and our full analysis, please download the PDF to read the full report