- Equities: Global equities traded mixed as rate fears resurfaced on the back of high inflation in US

- Credit: Tighter monetary conditions warrant preference for quality, loss-avoidance is key

- FX: FFR to peak at 5.25% instead of 5%; USD’s recovery to gain traction if DXY enters higher range

- Rates: G3 rates to stay higher for longer as initial hardlanding fears for 2023 appear unfounded

- Thematics: Ongoing premiumisation and stabilising raw milk prices in 2023 to support dairy industry

Related Insights

US inflation proves stubborn, Fed grows hawkish. Volatility dominated markets last week (ended 17 February) with major indices turning in mixed performances. This was driven by a combination of US inflation surprising to the upside (actual 6.4% vs. estimates 6.2%), rising US-China tensions, and an impending change in Bank of Japan (BOJ) leadership. Global equities were down 0.3%, with Developed Markets (DM) and Emerging Markets (EM) falling 0.1% and 1.4% respectively.

US equities had another challenging week amid hawkish commentary from the Fed. The S&P 500 and Dow slipped 0.3% and 0.1% respectively, while NASDAQ climbed 0.6%. Europe stocks had a strong week despite the uncertain macro environment; the FTSE 100 and Stoxx 600 rose 1.4% and 1.6% respectively. Asian equities also ended the week in red after the release of Hong Kong’s 2H2022 census data showed the country’s population dropped for the third consecutive year; The HSCEI and Hang Seng were down 1.9% and 2.2% for the week.

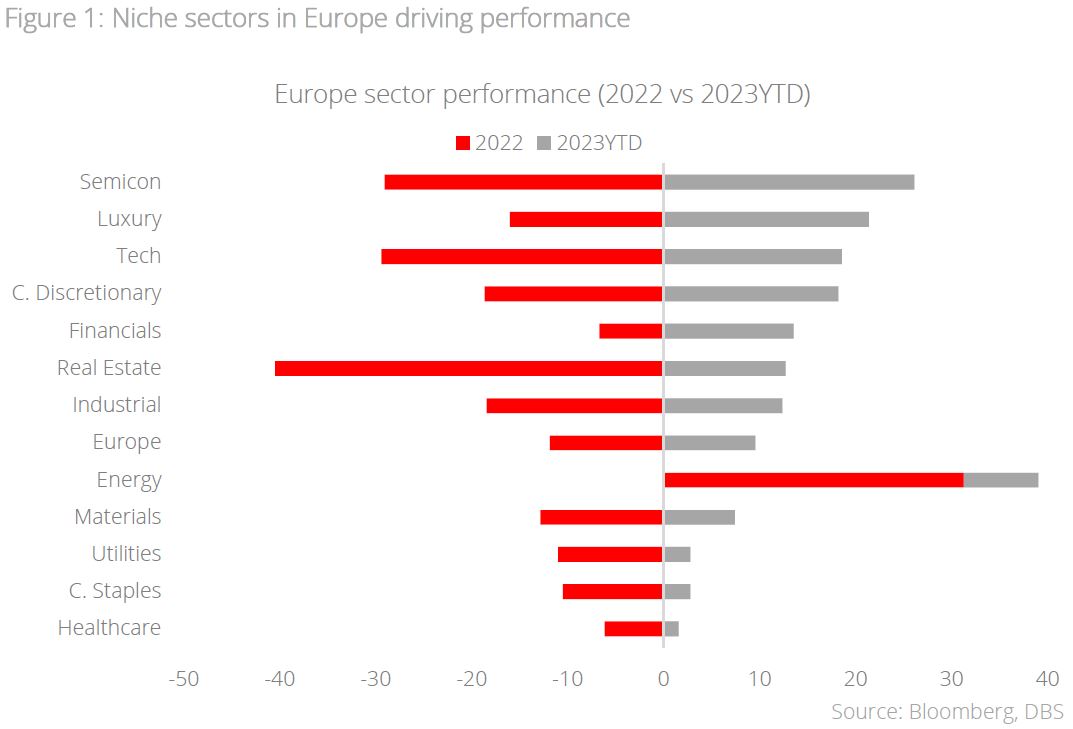

Topic in focus: Niche sector outperformance in Europe to continue. Europe returned 9% YTD following an improvement in global risk appetite. Returns, however are receding as economic data from the region continue to point to a challenging year ahead. Namely, financial conditions are tightening with higher rates and higher inflation, while growth outlook remains uncertain.

Sector returns during the quarter are focused on: 1) deeply oversold sectors such as global leaders across a range of industries exposed to structural growth end-markets, including semicon, which rebounded in line with global risk appetite as bond yields retreated; 2) sectors which have strong pricing power such as Luxury and Healthcare sectors; and 3) energy sectors where earnings and cashflow remain robust. Earnings for these sectors continue to beat expectations due to their niche characteristics. While the macro picture in Europe looks daunting, we believe exposure to these niche sectors in Europe should drive outperformance.