- Equities: Global equities down amid renewed Fed hawkishness, geopolitical tensions, China macro data

- Credit: Income generating opportunities even in high quality IG credit markets

- FX: DXY entered higher trader range between 102.7 and 104

- Rates: Upcoming CPI print critical in shifting debate on state of US economy

- Thematics: Positive outlook on HK banks given HK/China's economic recovery

Related Insights

Global equities slide amid uncertainty. Global equities were down last week (ended 10 February) with the exception of Japan, largely driven by a lack of consensus around leading macroeconomic indicators, and growing concerns that the current interest rate cycle still had legs. Global equities were down 1.4% for the week, with Developed Markets and Emerging Markets falling 1.3% and 2.4% respectively.

US equities notched a losing week amid underwhelming earnings, and fears that the Fed could turn hawkish due to an overly buoyant economy. The S&P 500, NASDAQ, and Dow slipped 1.1%, 2.4%, and 0.2% respectively. Europe stocks closed lower for the week as the Bank of England forecasted the country will enter recession in 1Q23; the FTSE 100 fell 0.2% while the Stoxx 600 slipped 0.6%. Asian equities fell amid lower-than-expected inflation figures in China and rising geopolitical tensions over the spy balloon incident; the HSCEI and Hang Seng were down 3.5% and 2.2% for the week.

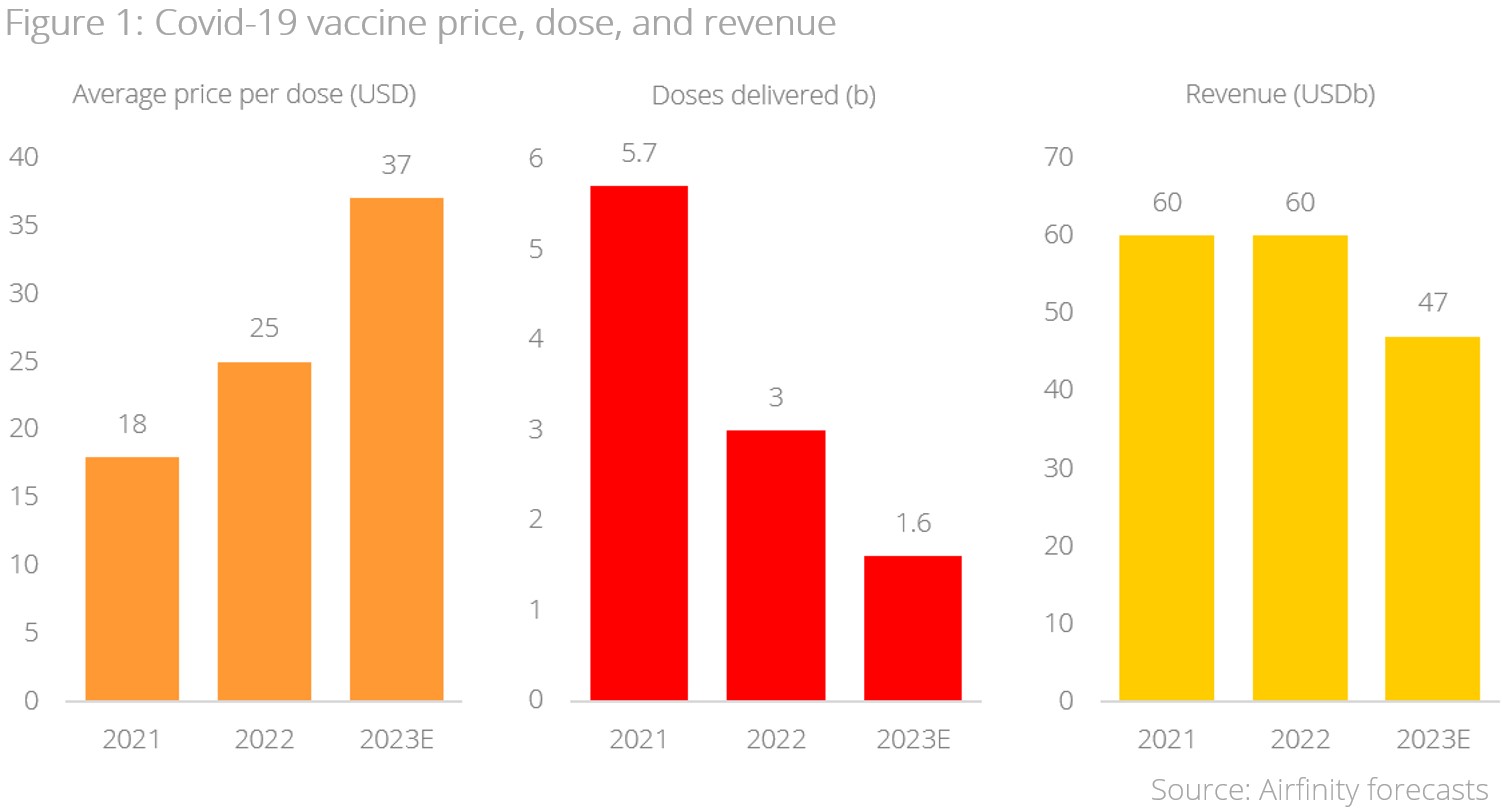

Topic in focus: Healthcare – mRNA vaccines to drive growth for Big Pharma. Even as vaccination rates climb and Covid inches toward becoming endemic, 2023 is set to be a big year for vaccine makers. This is largely due to the anticipated debut of commercial Covid vaccines, and the likely launch of the first mRNA vaccines for influenza and respiratory syncytial virus (RSV).

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.