- Equities: Global equities traded mixed from a resilient US labour market & negative news on Adani

- Credit: Bonds regain their diversification benefits as inflation abates

- FX: Stellar US job data puts greenback on level playing field against EUR

- Rates: The surge in US yields and fading of rate cut pricing is appropriate; expect more to come

- Thematics: We are positive on HK banks as HK/China’s economic recovery will support earnings growth

Related Insights

Global equities notch another winning week. Global equities ended another week in the green despite shaky trading across most markets on Friday (3 February) due to a stronger-than-expected January jobs report in the US. Global equities were up 1.0% for the week, with Developed Markets gaining 1.3% and Emerging Markets falling 1.2% respectively.

US equities fell on Friday as the economy added a whopping 517,000 jobs in January, significantly higher than economists’ estimates of 187,000, raising concerns that the Fed might continue aggressive monetary tightening. Nonetheless, the S&P 500 and Nasdaq ended the week up 1.6% and 3.3%, while the Dow slipped 0.2%. Europe stocks closed higher on the back of a sliding pound; the FTSE 100 rose 1.8% to hit an index record high while the Stoxx 600 edged up 1.2%. Asian equities had a rocky week of trading as allegations of accounting fraud by the Adani Group triggered risk-off sentiments; the HSCEI and Hang Seng were down 5.0% and 4.5% for the week.

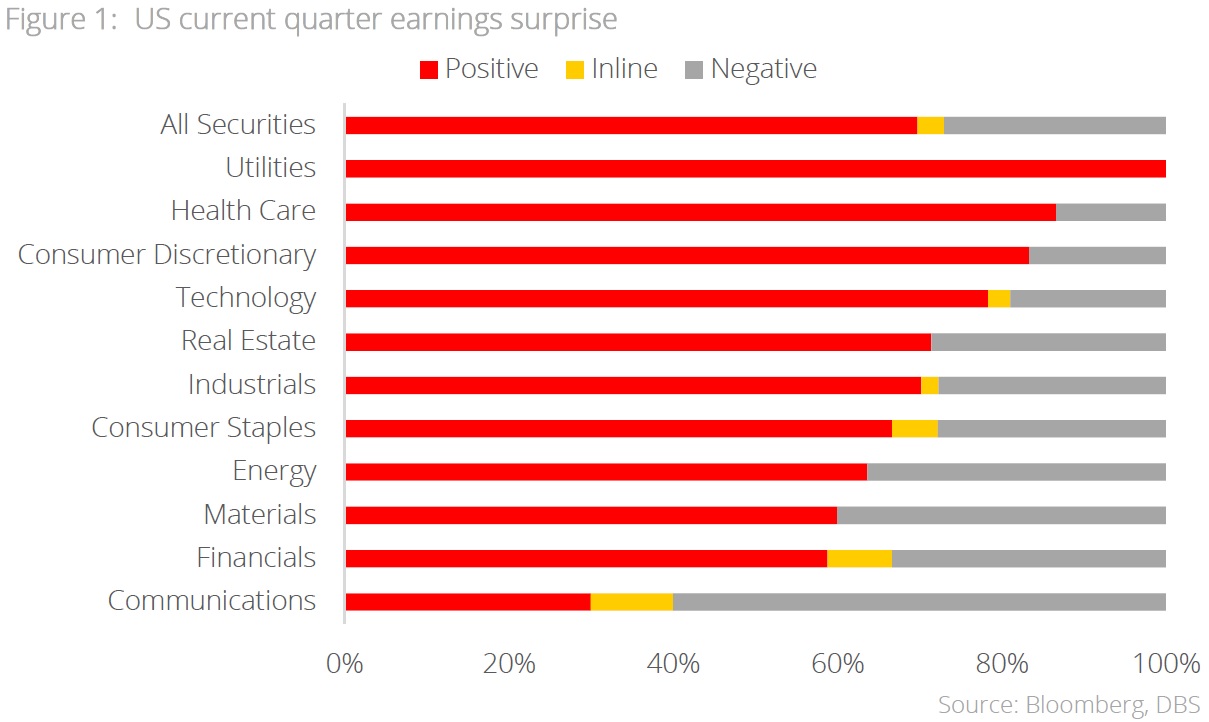

Topic in focus: Earnings surprise for S&P 500 companies remains flat. 50% of the companies in the S&P 500 have reported their earnings, with 70% of them registering positive earnings surprise (as of 3 Feb) and this is in-line with the previous quarter. On a sectoral basis, Utilities (100%), Healthcare (87%), and Consumer Discretionary (83%) registered the highest positive earnings surprise and this marks a stark contrast to the previous quarter where the top three sectors leading the pack were Industrials (82%), Technology (76%), and Healthcare (73%). In terms of earnings growth, 62% reported positive growth (vs 59% in previous quarter) and the top three sectors were Utilities (100%), Energy (100%), and Real Estate (86%).

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.