- Technology sector kickstarted 2023 with 15% YTD bull run

- Latest earnings have largely missed the mark but long-term outlook remains positive

- Companies have guided for bottoming of end demand, resilient pricing power, China reopening

- We reiterate our constructive stance on Technology and Big Tech

Related Insights

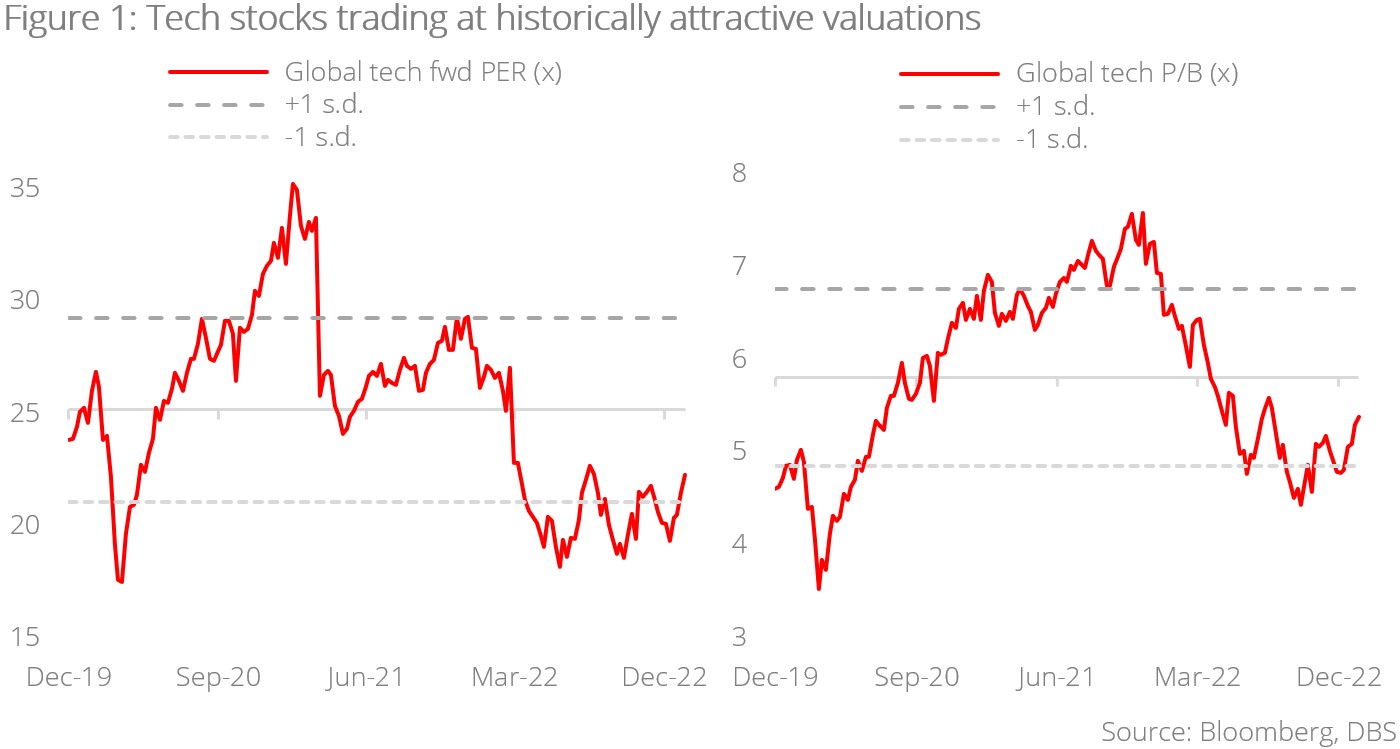

Technology stocks’ stellar performance. Global technology sector kick-started the year with a strong +15% YTD performance, significantly outperforming global equities (+8% YTD). This is an encouraging showing by all accounts after a turbulent 2022, which saw the sector correct some 30% due to a ‘perfect storm’ of headwinds: 425 bps of Fed rate hikes, high inflation, elevated energy prices, the Russia-Ukraine war, supply chain disruptions, and an impending global slowdown.

Investors are looking past current headwinds. In spite of the headwinds and perception of earnings weakness, technology firms have, against the odds, delivered promising results. Based on the list of S&P technology firms that have reported earnings, c.80% delivered better-than-expected results and only 18% were below. An improvement from 75% and 18% reported in the prior season, respectively.

Judging from the recent share price performances, it would appear that the challenges of 2022 have entered the rearview mirror as investors are gradually looking past them and forward to a better 2023 where technology firms’ operating and financial metrics are expected to recover.

Optimistic long-term outlook. While tech leaders have reported a mixed bag of earnings in their recent result announcements, their management teams have generally guided for an optimistic outlook driven by the bottoming in end-demand, resilient pricing power, staff size rationalisation, China reopening, and recovery in profitability.

To view more takeaways and our full analysis, please download the PDF to read the full report