Outperformance of CIO Barbell and I.D.E.A. Strategies

CIO strategies are off to a strong start in 2023

Chief Investment Office1 Feb 2023

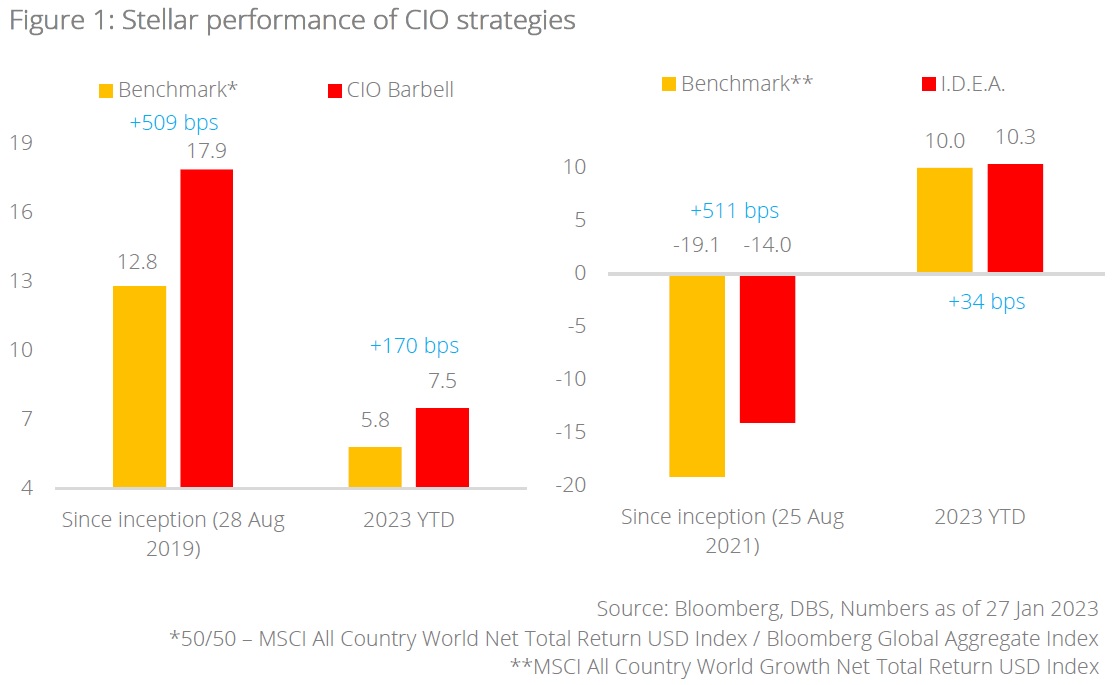

- CIO Barbell & I.D.E.A. strategies have outperformed benchmarks this year despite recession risks

- Since inception, CIO Barbell Strategy has outperformed its benchmark by 509 bps (170 bps YTD)

- The I.D.E.A. Strategy has outperformed its benchmark by 511 bps since inception and 34 bps YTD

- Investors are advised to re-engage the market and/or dollar-cost average as US policy rates peak

Related Insights

- Stay with Quality Amid Higher for Longer Rates 23 Feb 2023

- Reinforce Constructive Stance on Big Tech06 Feb 2023

- China Equities: Time to Start Dollar-Cost Averaging 08 Dec 2022

Photo credit: iStock

Read More

Strong start for CIO strategies in 2023. After a turbulent 2022 which saw equities and bonds falling in tandem in the face of central banks’ monetary tightening, the Russia-Ukraine crisis, and China’s Covid lockdown, financial markets have staged a sharp rebound this year despite looming recession risks.

The CIO Barbell Strategy and I.D.E.A. Strategy have delivered encouraging returns and outperformed their respective benchmarks in the current environment:

- CIO Barbell Strategy (YTD outperformance: 170 bps). The strategy is a multi-asset balanced strategy focused on secular growth and income stability, with the employment of gold as a risk diversifier. Since inception, the strategy has returned 17.9% and outperformed the benchmark (comprising 50% MSCI All Country World Net Total Return USD Index and 50% Bloomberg Global Aggregate Index) by 509 bps. On a year-to-date (YTD) basis, the strategy has returned 7.5% and this constitutes an outperformance of 170 bps.

- I.D.E.A. Strategy (YTD outperformance: 34 bps). I.D.E.A. (Innovators, Disruptors, Enablers, Adaptors) is a growth-oriented strategy investing in global secular winners of the digitalisation age. Notably, the strategy also possesses substantial exposure to “Adaptors” – old economy companies embracing digital transformation. Performance-wise, I.D.E.A. has substantially outperformed its benchmark (comprising MSCI All Country World Growth Net Total Return USD Index) by 511 bps since inception. On a YTD basis, the strategy outperformed by 34 bps.

Unique characteristics of CIO strategies:

1. CIO Barbell portfolio employs a strategy that is differentiated from most Balanced funds in the market

- The portfolio takes on two outsized exposures — income generating assets and secular growth equities.

- Besides corporate bonds, we add equities that yield sustainable dividends as another source for income generation. In the present environment, most of these stocks are “value” plays with below-than-average market valuation metrics (e.g. stocks within the Financial and Energy sectors).

- On the growth end of the portfolio, we go all-in on companies that ride long-term, irreversible growth trends. Companies within Technology and Healthcare feature greatly as they are beneficiaries of a fast-ageing population and accelerated digitalisation of the world economy.

2. Our I.D.E.A portfolio is also differentiated from general Growth or Technology funds in the market

- Besides Technology companies that fall into the categories of ‘Innovators’, ‘Disrupters’ and ‘Enablers’, our holdings include companies in traditional sectors such as retail and banks, which demonstrate the ability to pivot and thrive in a fast-changing digital world. We call them ‘Adapters’.

- We believe these unique characteristics would play out in the medium to long term, resulting in both Barbell and I.D.E.A outperforming underlying market indices.

Time to re-engage the market and/or dollar-cost average. We remain constructive on the long-term outlook of risk assets heading into 2023 and our conviction is underpinned by the following factors:

- Moderation in US inflation and peaking in US policy rates

- Companies with strong fundamentals and earnings quality to outperform the broader markets, with the support of attractive valuations

- Recovery in China’s outlook and earnings outlook

Against this backdrop, we advise investors with existing positions to dollar-cost average. For those with excess cash holdings, now is the time to deploy them using a robust portfolio approach.

Download the PDF to read the full report.

Topic

Sanggahan

PT Bank DBS Indonesia (“DBSI”) berizin dan diawasi oleh Otoritas Jasa Keuangan, serta merupakan peserta penjaminan Lembaga Penjamin Simpanan. Informasi di dalam publikasi ini diterbitkan oleh DBSI. Informasi ini berlandaskan pada informasi yang diperoleh dari sumber yang diyakini dapat diandalkan, tetapi DBSI tidak membuat pernyataan atau jaminan, tersurat maupun tersirat, sehubungan dengan keakuratan, kelengkapan, aktualitas, atau kebenaran untuk tujuan tertentu. Pendapat yang diungkapkan dapat berubah tanpa pemberitahuan. Setiap rekomendasi yang terkandung di sini tidak berkaitan dengan tujuan investasi secara spesifik, situasi keuangan dan kebutuhan khusus dari penerima tertentu. Informasi ini diterbitkan hanya untuk informasi penerima dan tidak akan diambil sebagai pengganti pelaksanaan penilaian oleh penerima yang harus mendapatkan nasihat hukum atau keuangan terpisah. DBSI atau individu yang terkait dengan DBSI tidak bertanggungjawab atas kerugian langsung, khusus, tidak langsung, konsekuensial, insidental, atau kehilangan atau kerugian lain apa pun yang timbul dari penggunaan informasi apa pun di sini (termasuk kesalahan, kelalaian atau kekeliruan pemberian pernyataan di sini, lalai atau lainnya) atau komunikasi lebih lanjut, bahkan jika DBSI atau orang lain telah diberitahu tentang kemungkinannya. Informasi di sini tidak dapat ditafsirkan sebagai penawaran atau permintaan penawaran untuk membeli atau menjual surat berharga, kontrak berjangka, opsi atau instrumen keuangan lainnya atau untuk memberikan saran atau layanan investasi. DBSI, direktur, pejabat, dan/atau karyawan dapat memiliki posisi atau kepentingan lain dan dapat mempengaruhi transaksi dalam sekuritas/surat berharga yang disebutkan di sini dan juga dapat melakukan atau berupaya melakukan perantaan, investasi perbankan dan layanan perbankan atau keuangan lainnya untuk perusahaan-perusahaan ini. Informasi di sini tidak dimaksudkan untuk disebarluaskan kepada, atau digunakan oleh, orang atau badan mana pun di yurisdiksi atau negara mana pun dimana distribusi atau penggunaannya akan bertentangan dengan hukum atau peraturan. Sumber untuk semua grafik dan tabel adalah CEIC dan Bloomberg kecuali ditentukan lain.

Related Insights

- Stay with Quality Amid Higher for Longer Rates 23 Feb 2023

- Reinforce Constructive Stance on Big Tech06 Feb 2023

- China Equities: Time to Start Dollar-Cost Averaging 08 Dec 2022

Related Insights

- Stay with Quality Amid Higher for Longer Rates 23 Feb 2023

- Reinforce Constructive Stance on Big Tech06 Feb 2023

- China Equities: Time to Start Dollar-Cost Averaging 08 Dec 2022