- Lower-than-expected inflation drives market euphoria; gold gains +8.9% from recent lows

- Demand tailwinds – central bank buying reaches >300% increase on a y/y basis

- Positive real rates, however, will form significant headwinds for gold from a return perspective

Related Insights

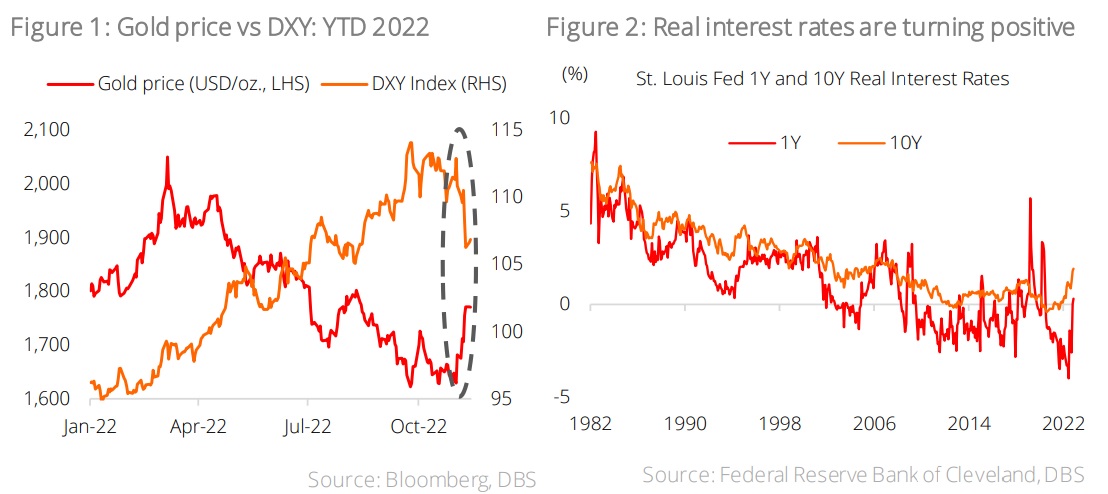

Gold rallies on slowing CPI data. The past week (ended 11 November) was a significant milestone for bullion as it recorded its best weekly performance (+5.3%) since March 2020, and an impressive +8.9% gain from recent lows in November. This rally was driven primarily by cooler-than-expected US CPI data for the month of November (actual: +0.4% m/m, consensus: +0.6%; actual: +7.7% y/y, consensus: +7.9%), which raised hopes of slower rate hikes moving forward and provided a brief respite from dollar strength (the DXY index ceded 4.1% for the week). This puts gold’s YTD performance at -3.0% and firmly establishes it as one of the top-performing asset classes for the year thus far.

A victim of positive real rates. Notwithstanding the strong relative performance of gold this year, there are undeniable headwinds facing bullion, chief among which are positive real rates. As can be seen in Figure 2, the 1Y real interest rate has nudged its way into positive territory since June 2020 while the 10Y real interest rate sits almost at 2.0%. This has a significant impact on the attractiveness of gold since the latter is a non-interest-bearing asset. As we wade deeper into a new regime of higher interest rates and inflation rolls over, this dichotomy between interest-bearing and static assets will become increasingly important in determining how investors allocate their capital.

Glimmer(s) of hope. Positive real rates and dollar headwinds are big challenges for gold, but there are some bright spots for its nearer term outlook. While the timing of a Fed pivot remains uncertain, there are indications that the pace of rate hikes may slow. This should weaken the dollar and provide some reprieve for gold, which is often seen as an alternative currency to the greenback. Geopolitical uncertainty is another potential tailwind for the safe haven asset; political turmoil in the UK (which saw multiple key appointment holder changes), continued ambiguity surrounding China’s zero-Covid policy, and the persistence of conflict in Eastern Europe, could all potentially provide a short-term catalyst for gold. Central bank buying has also kept gold prices buoyant – global purchases in 3Q amounted to almost 400 tonnes, the single largest quarter of demand from this sector since 2000 and more than a 300% increase on a y/y basis.

Download the PDF to read the full analysis.

Topic

DISCLAIMERS AND IMPORTANT NOTES

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.

Singapore: This publication is distributed by DBS Bank Ltd (Company Regn. No. 196800306E) (“DBS”) which is an Exempt Financial Adviser as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore (the “MAS”).

Indonesia: This publication is distributed by PT Bank DBS Indonesia (DBSI). DBSI is licensed and supervised by the Indonesia Financial Services Authority (OJK) and a member of the Indonesia Deposit Insurance Corporation (LPS). This publication is not and does not constitute or form part of any offer, recommendation, invitation, or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

India: This publication is distributed by DBS Bank India Ltd. (“DBIL”) and is on “as is” basis and for information only. This publication is not intended to be source of advice in respect of the material presented or information published, and shall not be construed to be legal, tax, financial or investment advisory. This document is not, and should not be construed as, an offer, invitation, recommendation, or solicitation to enter into any transaction in relation to any of the products and services mentioned herein. DBIL does not make any warranty of any kind, express or implied, including but not limited to warranties of completeness, accuracy of information, merchantability, or fitness for a particular purpose.