- United States: Stronger than expected US service PMI challenge markets’ dovish view

- New Zealand: Economy heads into recession as floods and Cyclone Gabriella exacerbate slowdown

- Thailand: Sentiment on goods exports deteriorated amid tougher global economic climate

- Indonesia: Discontinuation of several relief programs as Covid enters endemic phase

United States: Key data points released week of 13 February 2023 has challenged markets’ dovish view. Headline CPI rose by 0.5% in January, while core CPI rose by 0.4%, as energy, food, shelter, and some other prices reversed the recent cooling trend. Coming on the back of the 517k January payrolls print released during the previous week, this prompted Dallas Fed president Logan to state that continued rate hikes for a longer period than previously anticipated was on the table.

A key point made in Ms. Logan’s speech was that the recent decline in goods prices reflect improvement in supply chain conditions and little more, which is a source of limited comfort as “supply chains can’t recover twice.” Additional risks to goods prices in the coming month stem from Europe, which looks set to avert a recession, and strong ongoing rebound in China with the end of the Covid-Zero policy.

Surprisingly strong January retail sales data (+3% m/m) released on 15 February is further evidence that the economy is picking up momentum. Accordingly, the Atlanta Fed Nowcast is now tracking 1Q GDP growth in the 2.5% range. Manufacturing output has picked as well, with firms picking up cues from reviving demand for cars, furniture, appliances, and restaurants. Relatively warm weather has supported this trend.

Producer price data came in late in the week of 16 February, firing the third salvo against the dovish camp. While the PPI is no longer in the double-digit annual growth territory like it was last summer, it is still up 6% y/y, held up by a 0.7% m/m rise last month. Producer prices are capturing two dynamics: first, firms are still facing high cost of production, including from wages and material inputs; second, they are finding demand strong, which makes them more amenable to hike prices.

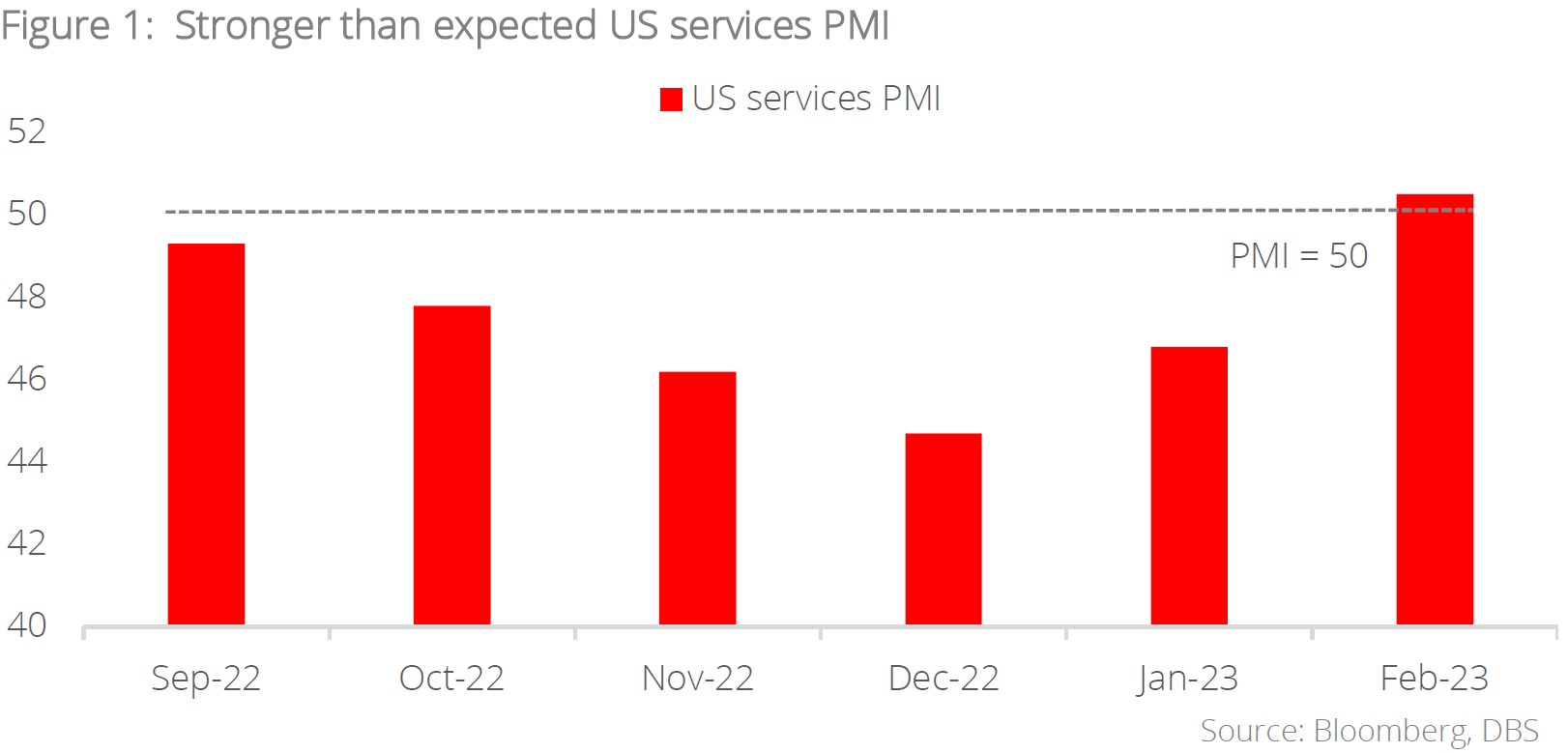

Furthermore, the US services PMI results released this week also turned out to be stronger than expected. The services PMI for February surged to an expansionary level of 50.5 (Jan: 46.8), registering its strongest read since June 2022 and coming in well above consensus expectations.

Download the PDF to read the full report which includes insights on New Zealand, Thailand, and Indoensia