Key Points:

- Mutual funds offer the benefit of diversification within a single instrument.

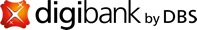

- To be more effective, use the Core-Satellite approach, which involves a "core" portfolio for long-term stability and a "satellite" portfolio for active management and short-term opportunities.

- Differentiating mutual funds in this way strengthens your overall portfolio and ensures that your gains don’t rely on a single investment.

- Digibank DBS offers mutual fund investment options to help facilitate portfolio diversification and reduce market risk.

Interested in investing and capturing opportunities with more confidence?

Diversification Is Key

Imagine your investment portfolio as a fruit basket. If you only fill the basket with apples, and one day those apples rot, your entire basket is at risk. However, if you fill it with a variety of fruits—apples, oranges, bananas—when one type of fruit declines in quality, you still have others to enjoy.

A well-diversified investment portfolio, built around your investment goals, preferences, time horizon, and risk tolerance, can help you navigate market challenges while maximizing returns. Diversification ensures that your portfolio’s overall performance isn’t dependent on one underperforming asset.

With mutual funds, you can achieve diversification more easily than by purchasing individual securities. This makes it more practical, effective, and simple to do. The benefits of mutual funds can be optimized if you diversify based on geography, fund manager, sector, or the assets held by the fund—as long as they align with your investment goals and are applied with a clear strategy.

At DBS, we recommend the Core-Satellite Approach to Build a resilient portfolio for long-term gains.

How to Make Mutual Fund Investments Work for You

Designing a mutual fund portfolio is like tailoring a custom outfit; there’s no one-size-fits-all approach. However, there are some general principles to consider when selecting and combining mutual funds.

- Choose funds with a focus and strategy that align with your goals and preferences.

- Secondly, pay attention to your current portfolio composition so new selections complement it.

- Thirdly, apply the Core-Satellite Approach to diversify your mutual funds.

Broadly speaking, this strategy divides your portfolio into two parts:

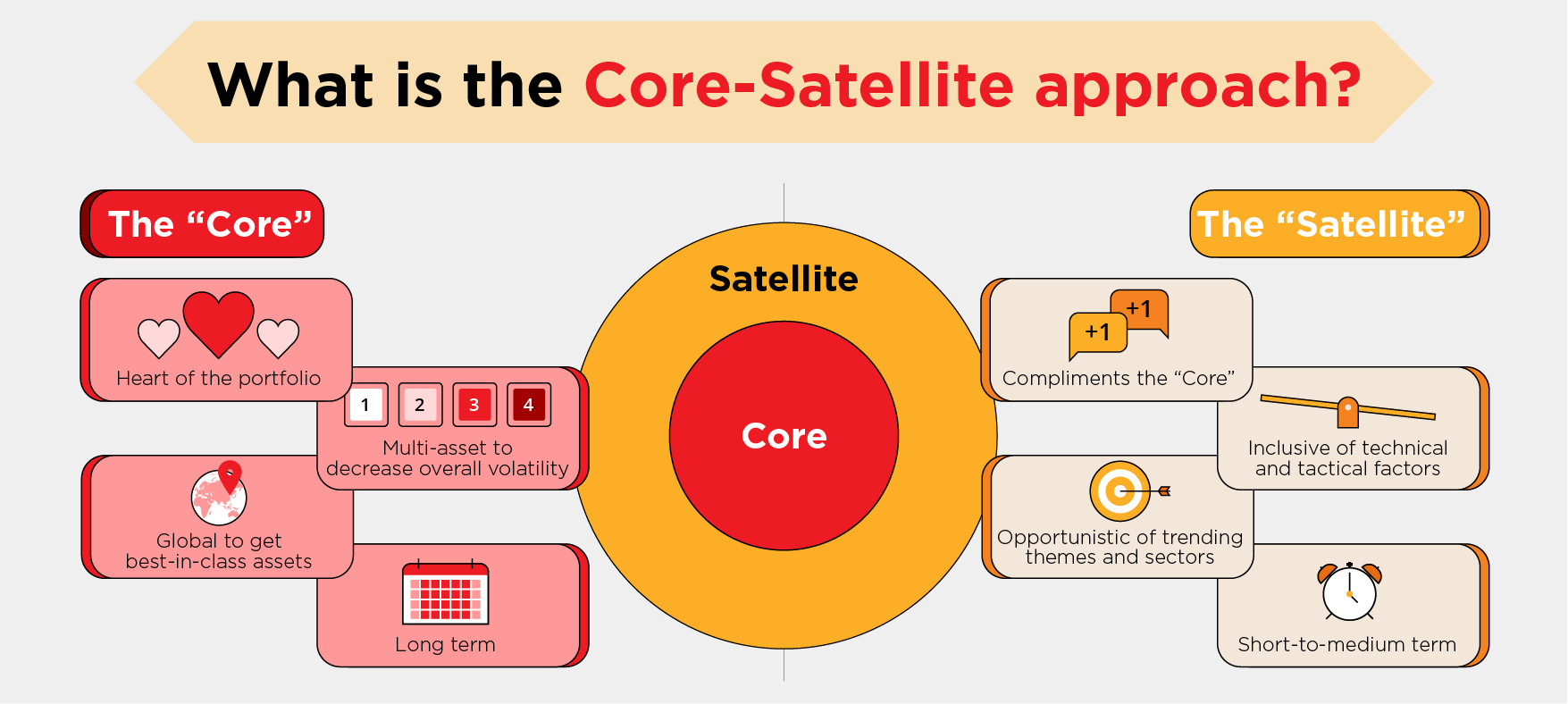

- The "core" of the portfolio should consist of various asset classes that are global in nature. This will reduce overall volatility and ensure you hold the top asset classes for the long term.

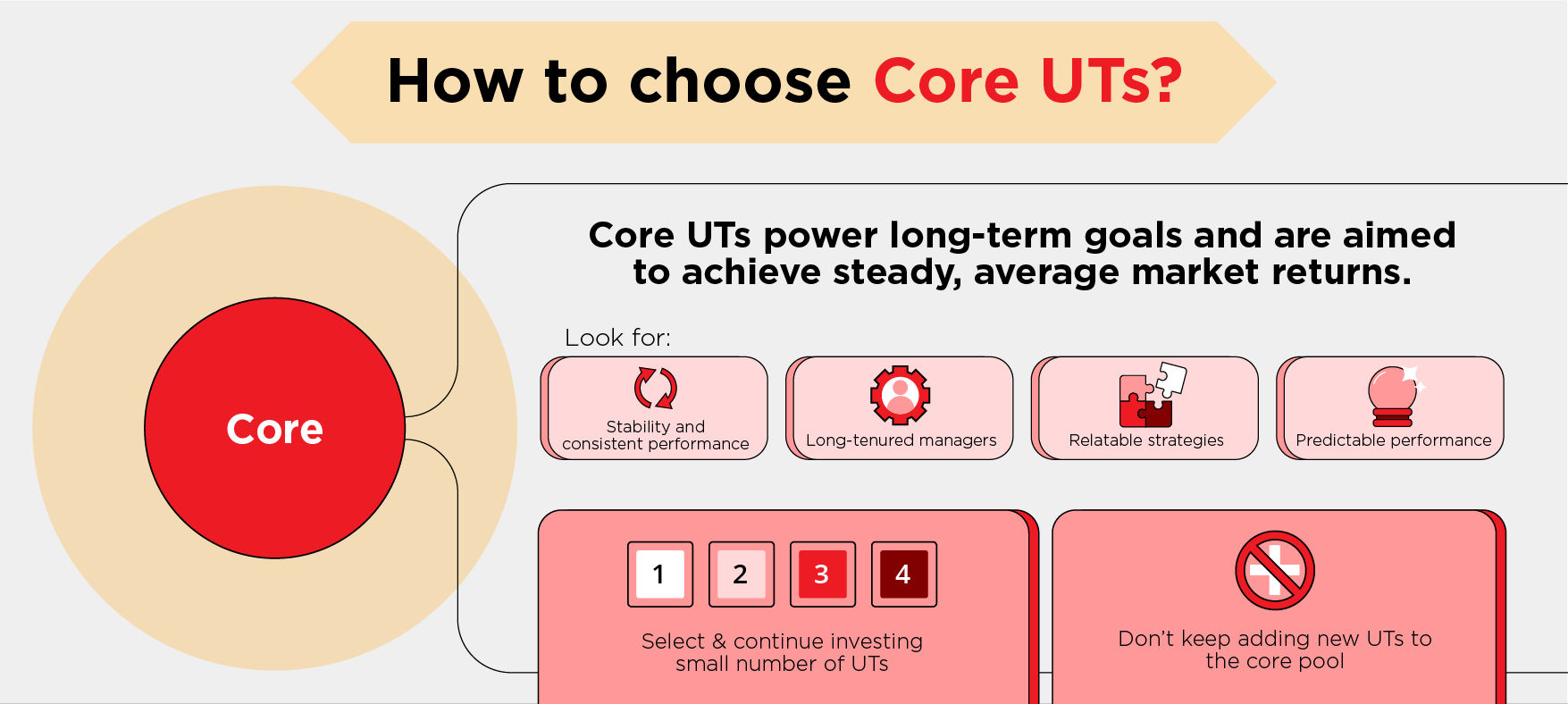

- The "satellite" part of the portfolio is for capturing short- to mid-term opportunities with higher return potential. This allows you to take advantage of current market factors such as valuations, trending themes, and specific sectors.

How Is the Core-Satellite Strategy Applied to Mutual Funds?

With this concept, your portfolio is positioned to achieve market-average returns with a stable "core" of long-term investments, while also aiming for above-average returns with the more tactical "satellite" components.

Ready to Get Started?

At first, investing can feel overwhelming with so many mutual fund options available. But with clear step-by-step guidance, the process can be relatively simple:

- Start with your financial goals and investment time frame. This will determine the right mutual fund choices.

- Select based on the unique value of the mutual fund, such as valuations, growing sectors, or higher potential returns.

- Identify allocations for your "Core" and "Satellite." Create a strategy to leverage attractive opportunities without jeopardizing your overall investment.

- Adjust based on macroeconomic views. Keeping an eye on market movements can help narrow down mutual fund choices that align with your current portfolio composition and boost overall performance.

Contact digibank Advisors, a trusted team that provides guidance on investment product options tailored to the market and your needs. You can chat, discuss your financial plans and goals, receive updates and insights on market trends, get investment product recommendations based on your risk profile, and even take advantage of promotional programs to enhance your investment returns.

This service offers a comprehensive approach to investment management, ensuring your financial decisions align with your goals and risk tolerance while seizing market opportunities. Get ready to start investing with digibank by DBS!