Key Points:

- An investment portfolio is like your wardrobe – a collection of handpicked pieces that fit your needs, profile and preferences.

- You will have ‘basics’, such as stocks, bonds, unit trusts and cash; even a few ‘adventurous’ pieces like commodities or FX.

- Your wardrobe may even be trendy or contain seasonal collections! But it is still important to do regular spring cleaning to ensure that the pieces are serving you well.

- Similarly, regular portfolio rebalancing will ensure that your investments reflect your specific needs and objectives.

Keen to tailor an investment portfolio just for you?

Building an investment portfolio is like building out your wardrobe – it’s a collection of handpicked pieces that fit your needs, profile and preferences. There are the ‘basics’, such as stocks, bonds, unit trusts. Probably a few ‘adventurous’ pieces, like commodities or FX. And of course, the reliable go-to for any situation, cash.

Just as there are seasons and trends in fashion, your portfolio could contain investments that are doing well with the market. But it is important to always ensure that your portfolio reflects your specific needs and objectives. You achieve this through portfolio rebalancing – a regular exercise to maintain the original asset allocation. Here are a few principles to get started.

Every portfolio should be made up of several asset classes. As each class performs differently in the same market environment, investing in multiple classes reduces the risk that any set of conditions will hurt your entire portfolio.

For example, the ‘equities’ class can be made up of equity unit trusts; akin to how ‘shirts’ come in many colours and designs.

Each asset class has a weight, or the percentage of the total portfolio value. So if you’ve Rp30,000,000 worth of equity unit trust in a Rp100,000,000 portfolio, the weight of equity unit trust in your portfolio is 30%. The relative weights of individual asset classes, or asset allocation, is tailored to you depending on your risk preference.

Login to your digibank app to begin assessing your investment risk profile.

When it comes to your wardrobe, too many of the same piece may make your ensembles less versatile.

Similarly with your portfolio, it’s best not to have too much of a single asset, for instance a stock in a Tech Company / Big Tech Company. Any movement in the asset could have a disproportionate effect on your portfolio. This is called concentration risk.

One rule of thumb is the 5% rule. You don’t want one unit trust or any other security to exceed 5% of your total portfolio value. So, if market gains in one security pushes it above 5%, sell some of it and buy more of another.

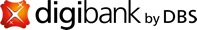

Over time, you might find the make-up of your wardrobe changing. One day, you may realise that you have too many white shirts, or perhaps you’re running out of casual wear for the weekend. Maybe some seasonal collections are not suitable anymore.

It happens with portfolios too. But unlike your wardrobe it can happen without you realising it, due to asset classes performing differently in the same market.

Let’s say you have an allocation of 50/50 equity unit trust and bonds. If the equity market performs phenomenally, the value of your equity unit trust will rise in relation to bonds. This means your portfolio no longer fits your risk profile and needs to be rebalanced.

In reality, rebalancing is a much more complex task. You’ll have to consider the risk levels of individual assets to buy and sell, to maintain your preferred allocation without changing your portfolio’s risk profile.

To help with this challenge, our Chief Investment Office publishes quarterly model portfolios for various risk appetites – Conservative, Moderate and Aggressive. You can align your portfolio with the DBS house view by consulting with our digibank Advisor!

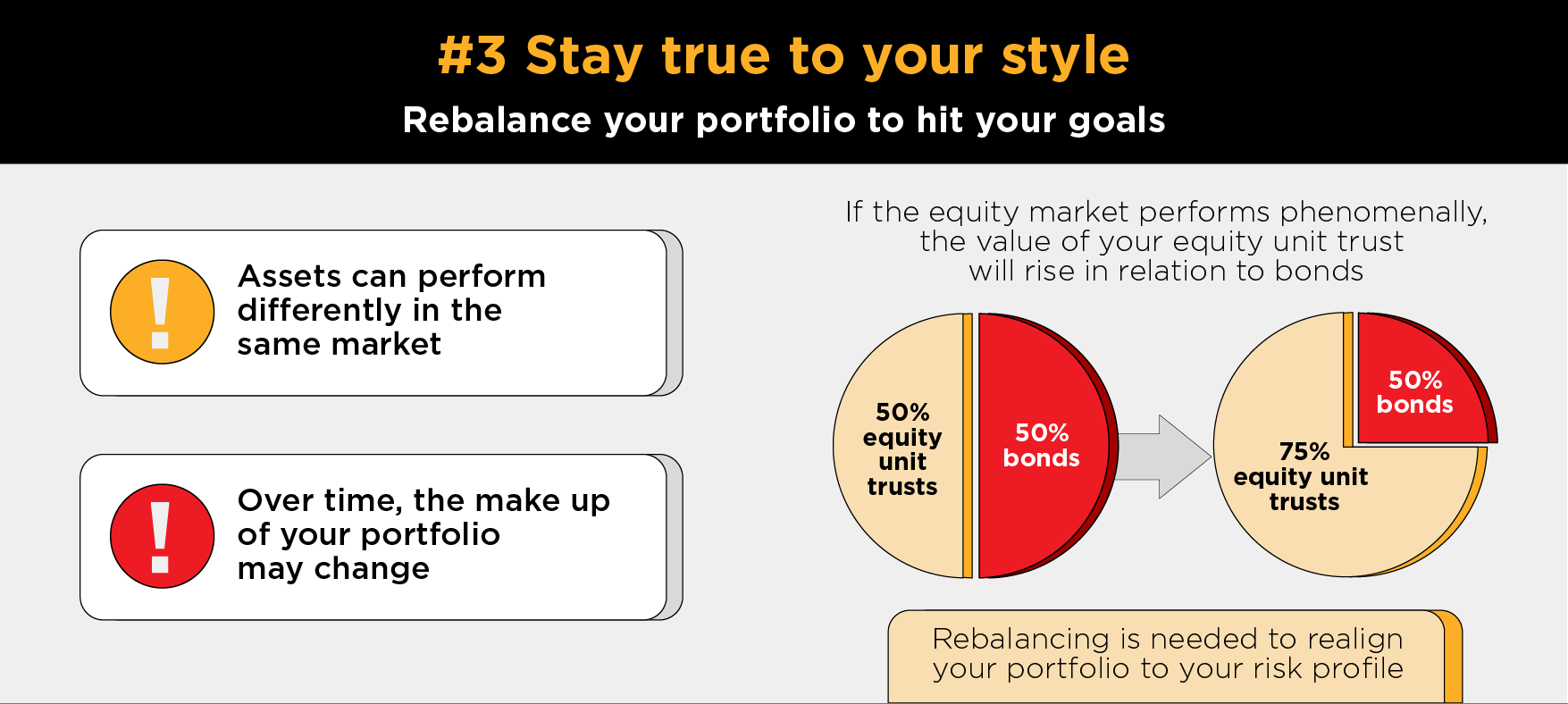

If you’ve ever had a style consultant assemble a wardrobe for you, you’ll be impressed by the sharp eye for pieces that look just right.

The investing equivalent will be portfolio managers who’ll handle the nitty-gritty of rebalancing for you. These experts specialise in researching, building and maintaining portfolios.

Get in touch with our digibank Advisor team, a certified team that provides guidance on investment product choices tailored to the market and your needs. You can have a chit chat, discuss financial plans and goals, receive updates and insights on market trends, recommendations for investment products based on your risk profile, and even be presented with promotional programs to enhance your investment returns.

This service offers a comprehensive approach to investment management, ensuring that your financial decisions align with your goals and risk tolerance while taking advantage of opportunities in the market.

Let’s get ready, start investing with digibank by DBS.