Key Points:

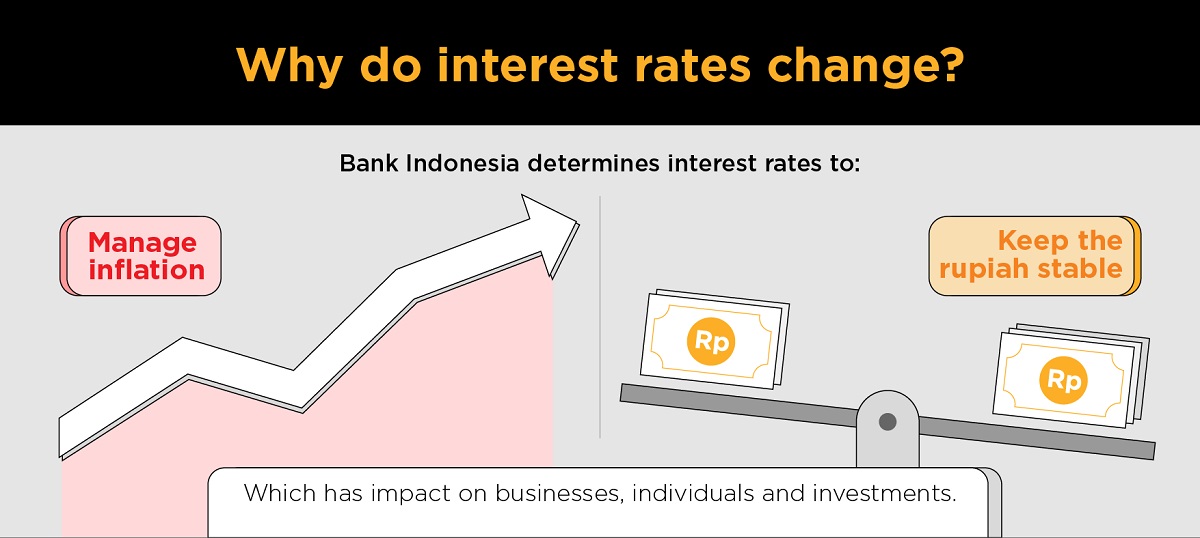

- Interest rates are determined by central bank decisions.

- Bank Indonesia is poised to be more dovish in the second half of 2024.

- When interest rates start falling, savings are less attractive due to lower deposit rates.

- Investment opportunities can be found in growth sectors or higher yielding assets like bonds, stocks or mutual funds.

Keen to explore market opportunities with greater assurance?

Interest rates are determined by central bank. They may be adjusted to stimulate or curb a country's economic growth. For Indonesia, this role falls to Bank Indonesia (BI), which has focused on managing inflation and keeping the rupiah stable.

Over the past few years, BI has raised interest rates to keep pace with the US Federal Reserve rate hikes. But this may change in the second half of 2024. DBS economists think that BI may begin to cut rates towards the end of the year.

This will definitely affect businesses, individuals and ultimately your investments. But understanding the impact and having a strategy for investing will help you ride the wave with confidence.

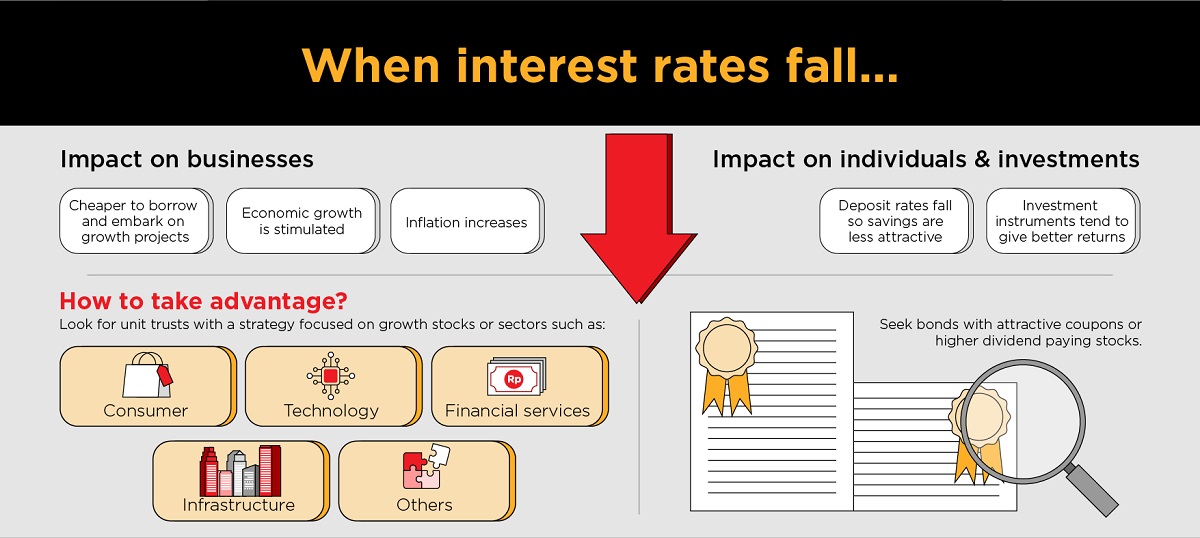

What happens when interest rates fall?

In general, low interest rate stimulates economic growth and increases inflation. This is because it is cheaper for businesses to borrow.

With a reduced cost for businesses to borrow money, businesses will likely embark on growth projects such as business acquisitions and expansions and product developments.

Invest for better returns

Savings are less attractive due to lower deposit rates; individuals are likely to invest spare cash into investment instruments for better returns.

Sectors that benefit from falling interest rates

- Look for unit trusts with a strategy focused on Growth stocks or sectors such as consumer, technology, financial services, infrastructure, and others.

- Seek bonds with attractive coupons or higher dividend paying stocks. If you are holding to such high demand assets, this might be an opportunity to capitalise your assets.

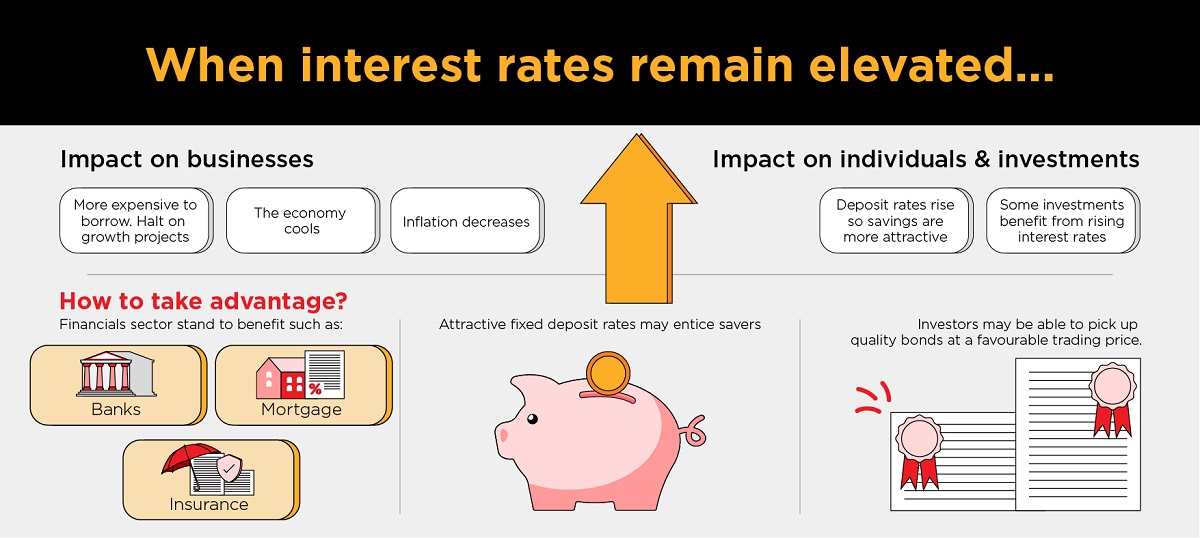

What happens when interest rates remain elevated?

In general, high interest rates cool an overheated economy and reduce inflation. This is because higher interest rates makes borrowing costs impede business plans, and businesses will likely halt or reduce growth projects. Savings are more attractive due to higher deposit rates; individuals may consider investing in assets, businesses or sectors that will benefit from rising interest rates.

Sectors and assets that benefit from elevated interest rates

- Financials sector such as banks, mortgage and insurance companies stand to benefit as interest rate hikes.

- Attractive fixed deposit rates may entice savers. Investors may be able to pick up quality bonds at a favourable trading price.

With digibank by DBS, you can access expert macroeconomic forecasts and investment recommendations from our world-class team, offering over 120++ curated products from Bonds to Mutual Funds to navigate your future, allowing strategic and seamless investment even amidst fluctuating rates. Contact us now!