Key Points:

- When markets are volatile, understanding whether they are in the bull or bear market phase is a good starting point in your investment journey.

- A bull market is marked by consistently rising prices, while a bear market is the opposite, with prices that are consistently falling.

- In a bull market, buy-and-hold strategies may be suitable; whereas in a bear market dollar-cost averaging and portfolio rebalancing are viable approaches.

- Above all, it is important to retain a long-term approach towards investing and equip yourself with the right tools and advice for the journey.

Keen to explore market opportunities with greater assurance?

When markets are volatile and investment analysts have conflicting views, selecting a suitable investment strategy can get extra challenging. A good starting point is to understand what stage the markets are at – is it a bull or bear market?

Identifying bull and bear markets is not a straightforward task as there are many factors involved. But it you think of investing like hiking, analysing the markets is similar to assessing your trekking route and weather conditions, which ultimately indicate if you will have a leisurely or strenuous trail ahead.

Similarly, the hiking gear you have is akin to the investment tools that you would use to plan your portfolio; while your fitness level is like your investing skills and resources, and would determine how much risk you’re willing to take on your hike and your investment journey alike. And you can definitely think of the team of investment experts at DBS as your mountain guide or experienced hiking buddy who is integral in the success of your hike.

Thus, let’s explore how to distinguish a bull or bear market, and the investment strategies that tend to do well in these scenarios.

How do you identify a bull market or a bear market??

Fundamentally, a bull market is marked by consistently rising prices, while a bear market is the opposite, with prices that are consistently falling. Prices would also need to rise or fall by about 20%, in order to confirm it is a bull or bear market.

When markets are volatile, however, prices can change direction quickly. This leaves many investors wondering if the bull or bear market that they saw earlier was real, whether it will resume, or whether it is over.

At this point, focus your attention on the real reason why prices are changing – the imbalance in supply and demand for the investment you’re looking at. Take stocks for instance:

When demand for stocks is | And supply of stocks is | The result |

|---|---|---|

Strong | Not enough | Rising prices |

Weak | More than enough | Falling prices |

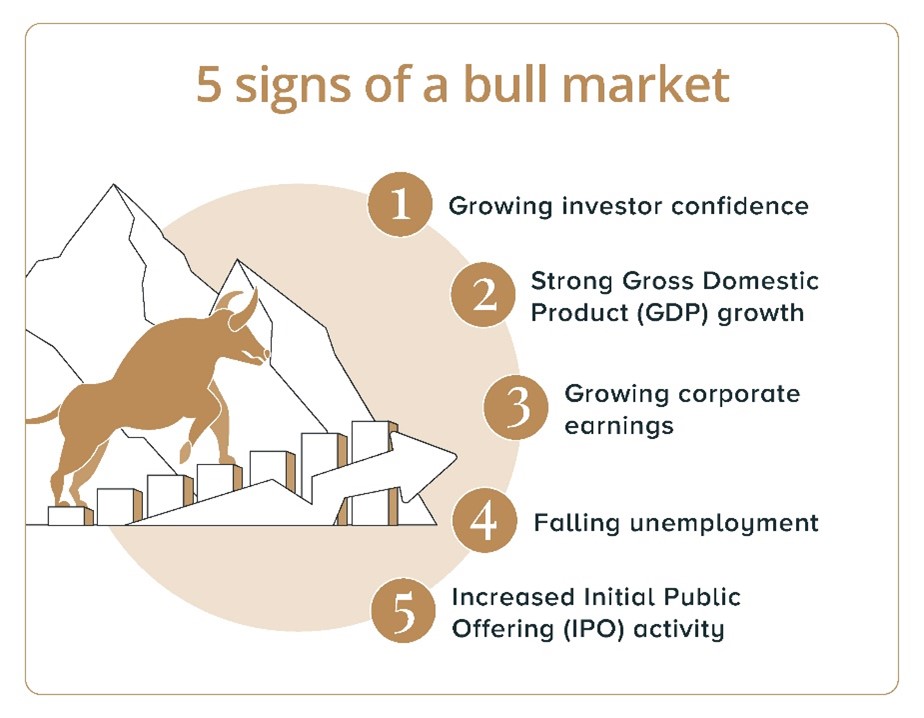

To assess if the bull market or bear market will continue, look out for the following signs.

In a bear market, the opposite is often (though not always) true. Investors are less optimistic about the market and tend to be more reluctant to invest in equities as prices fall.

A bear market could also coincide with periods of slowing economic growth. Signs of this include weaker corporate earnings and high unemployment rates. Another key sign of a bear market: When major central banks such as the US Federal Reserve lower their domestic interest rates.

Investment strategies for a bull market

In a bull market, you would be investing as prices are going up. If you believe prices will continue to go up, you could opt for a buy-and-hold investment strategy. This means that you buy and you hang on, expecting that the longer you stay invested, the higher the value of your investment.

An alternative is the increased buy-and-hold strategy, which is a variation of the buy-and-hold strategy where you continue to buy even as prices increase. Consider this strategy only if you are confident that your investments are still undervalued and will be worth more in future.

However, there will still be periods of volatility and price fluctuations even in a bull market. To invest amid such volatility, consider the retracement additions strategy, in which you buy when prices correct and hold them until they recover.

Investment strategies for a bear market

When investing in a bear market, dips in the markets are often more difficult to identify than the highs. It is also more challenging to make sound judgement calls when affected by pessimism and negative news.

So, when investing in a bear market, the key lies in maintaining a long-term view.

Consider the dollar-cost averaging (DCA) investment strategy, which divides your funds into bite sized portions, and investing each portion at fixed intervals. Doing so buys you more shares when prices are lower, and fewer shares when prices are higher. This helps to lower your average purchase price and makes your investment less vulnerable to price fluctuations. When your cost is lower, your returns will improve too.

It also helps to rebalance your investment portfolio back to its long-term asset allocation target. Rebalancing is especially important to maintain shape in a bear market, as the prices of some of your investments would have fallen faster than others, throwing your overall portfolio asset allocation off-balance. This can also help you reap the gains from a market recovery.

Lastly, investors should be careful not to sell in a panic. If you have sufficient cash to ride out the bear market, try not to be affected by short-term price movements.

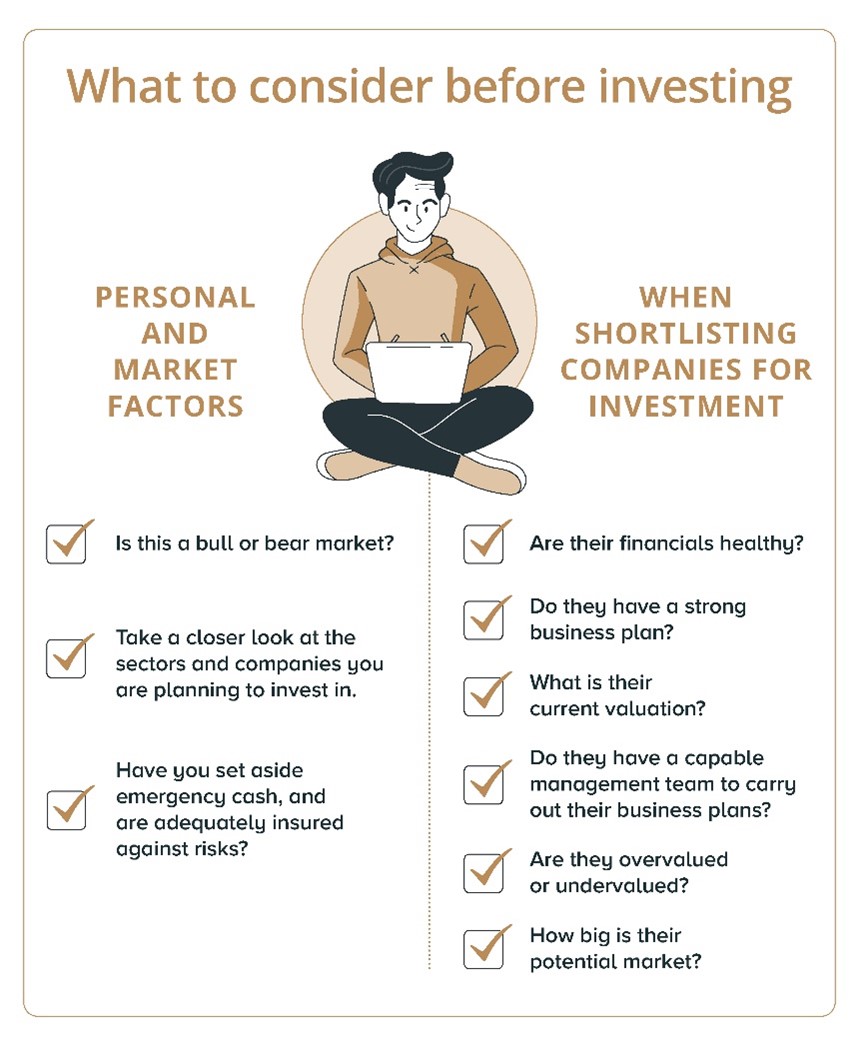

Consider these factors before investing

Whatever type of market we are in, there are personal and market factors to consider before investing. Once you’ve identified some companies as potential candidates to invest in, shortlist them by assessing these factors:

Tap on experts to be your guide

When markets are volatile, it can be challenging to build a robust investment portfolio. Just like hiking Mount Kilimanjaro, the journey is more pleasant with the appropriate hiking gear and experienced mountain guides.

Your investment journey is unique to you, and at DBS, feel free to drop by and have a chat with us anytime.

Connect with our digibank Advisor squad, a certified crew dedicated to steering you towards investment products perfectly matched to both the market and your unique needs. Dive into discussions about your financial plans and aspirations, stay in the loop with the latest market trends, snag personalized recommendations for investment products based on your risk appetite, and score exclusive promotional programs to supercharge your investment returns.

Ensuring that every financial move you make with us, is in sync with your goals and risk tolerance, all while seizing the best opportunities the market has to offer.

Whatever your needs for today or tomorrow, access smart wealth solutions that work for your preferences and risk appetite, even as your needs change.