Key Points:

- Fear of investment losses is normal, but keeping too much cash can decrease your asset value.

- Time is your friend. The longer you invest, the lower the chances of experiencing losses.

- Understand your risks and goals to balance risk and reward in your investments.

Start your investment journey in a measured and directed way with a trusted partner.

Want to start investing but still hesitant? Don’t worry, you’re not alone! Many people fear making the wrong decisions and end up not investing at all. However, with high inflation, keeping cash in the bank can reduce its value. Being too afraid to take risks can also hinder you from reaching long-term financial goals like retirement funds.

A healthy fear of losses can actually be beneficial, as it makes you more cautious. But don’t let this fear stop you completely. Instead, focus on taking measured risks. Let’s break it down!

Best Long-Term Investment Options

History shows that stocks tend to provide better returns compared to bonds or cash. Even though the Indonesian market is younger than the US market, the same principle applies. Stocks have the highest risk but also the highest potential returns. Remember the phrase "High Risk High Return"? Mutual funds, especially Equity Mutual Funds, offer an easy way to invest in stocks without having to pick individual stocks yourself. Our professional team will manage your investments and diversify your portfolio to manage risk according to your needs.

Check These Before You Start Investing

- Ensure an Emergency Fund: Prepare an emergency fund of 3-6 months of expenses for urgent needs. If you have dependents or are self-employed, save an emergency fund for 12 months.

- Evaluate Your Budget: Cut unnecessary expenses and redirect them to savings or investments. Make sure to invest with money that isn’t needed for daily needs.

- Avoid Excessive Debt: Pay off high-interest debt before investing. High interest can erode investment gains.

- Prioritize Goals: Separate money for short-term and long-term goals to avoid the temptation of withdrawing investments prematurely.

- Protect Yourself with Insurance: For example, health insurance covering inpatient, outpatient, and critical illness to prevent using investment funds for medical costs, or life insurance if you have dependents.

With adequate emergency funds and insurance, you’ll be better prepared to face risks and can invest more calmly and confidently.

Tips to Overcome Investment Fears

- Time is Your Friend: Investing requires discipline and patience. Don’t focus on short-term results, as investment values usually fluctuate. In the long run, the economy tends to grow, and companies generate profits that flow to investors. Start small and gradually build your portfolio. With the Regular Mutual Fund from digibank by DBS, you can start investing with just Rp100,000.

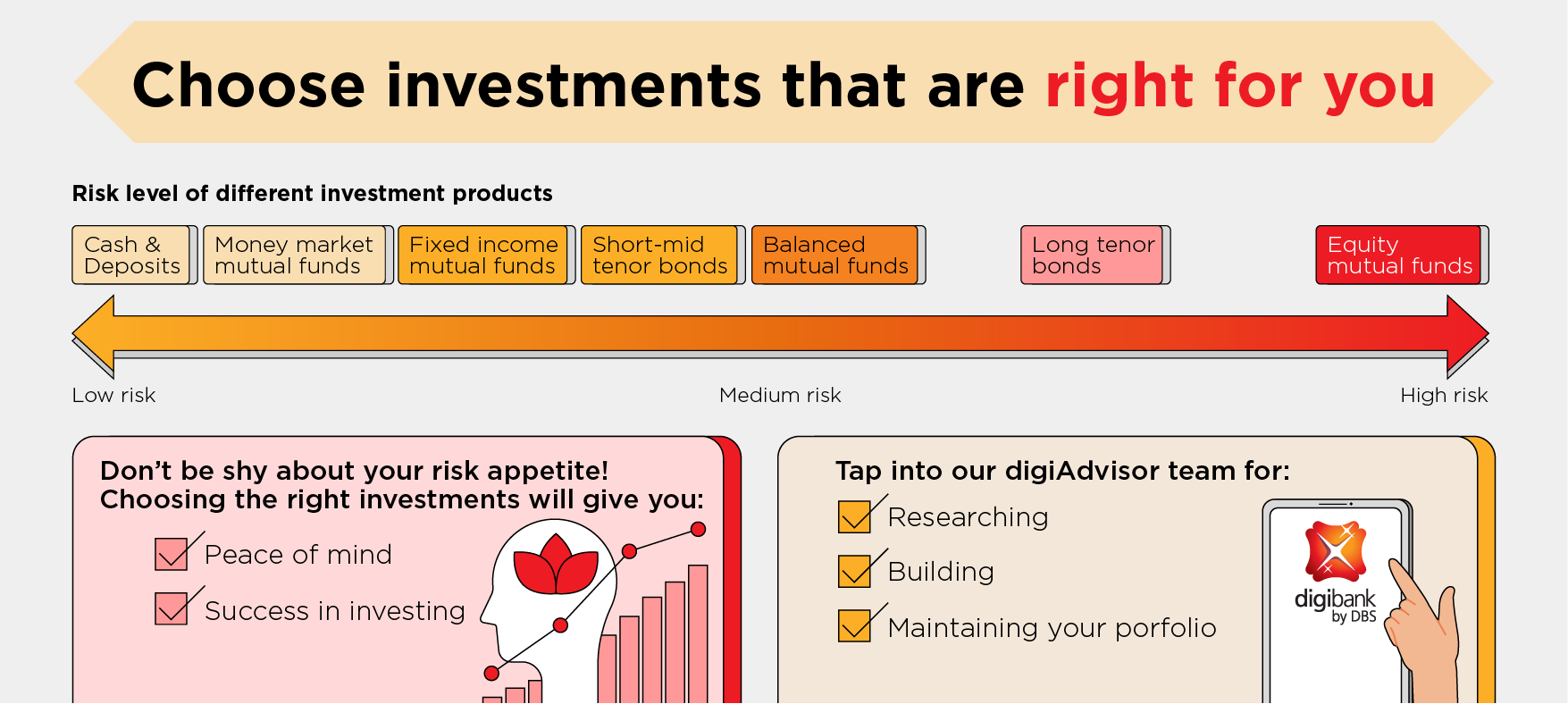

- Know Yourself and Your Investments: Everyone has different risk tolerance. Understand your risk profile, including your financial situation and investment preferences. This helps you and your financial advisor choose the right investments.

- Match Investments with Your Risk Tolerance: Fill out the risk profile questionnaire honestly. This alignment is crucial to avoid emotional or financial stress. If unsure, consult with digibank Advisor or use the regular investment planning at digibank.

Avoiding investments due to fear of losses can hinder your financial goals. Focus on the long term and understand the risks you can take. With good planning and patience, you can face the world of investments confidently. digibank by DBS is ready to help you every step of the way, with expert guidance and access to investment recommendations from our world-class team. Start investing with confidence!